2021 Cattle and hog sectors outlook update: Lack of moisture and excessive heat pressure the West

This is the second of three updates to our February cattle and hogs Outlook. The update to our 2021 Outlook for major crops was published two weeks ago and the 2021 Dairy Outlook update was published last week. Next week, we’ll update the 2021 Outlook for broilers.

Canada’s red meat sectors will see a third quarter of mixed profitability in 2021. Periods of extreme heat and severe declines in normal moisture levels have hit western cattle producers hard, with possible strong ripple effects for individual operations throughout the remainder of the year. Feed costs remain elevated in both the east and the west, but conditions may prompt lower prices as more cattle are marketed earlier. Hog sector margins will vary over the next quarter, with forecasted improvements for the end of the quarter.

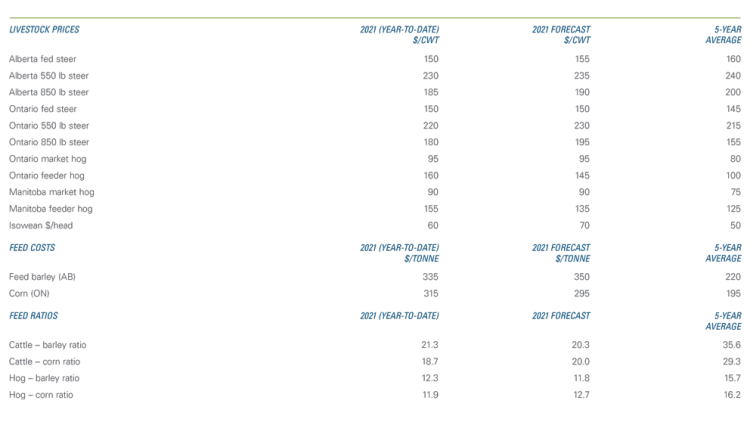

We expect all livestock prices to climb higher throughout 2021 than we had forecasted in May (Table 1). Year-to-date prices have been boosted by lower cattle slaughter than anticipated in both Canada and the U.S. Nonetheless, prices for western cattle remain below their five-year average. The wild card will be basis levels, which have been trending downward. If liquidation intensifies, prices could drop sharply.

It’s a different story in eastern Canada. Prices for hogs in both Manitoba and Ontario should continue to exceed their five-year averages on the strength of global and domestic demand. Chinese pork imports have largely driven strong global demand and continued strength in North American hog prices.

Table 1: Cattle and hog prices continue to rise above 2020 prices

Sources: Statistics Canada, AAFC, USDA, CanFax, CME Futures, and FCC calculations.

In February, we identified African Swine Fever, feed costs and growing global demand for red meats as the three dominant forces impacting profitability of the Canadian red meat sectors. However, weather-related impacts on feed crops in 2021 may prove to have the most significant influence on margins.

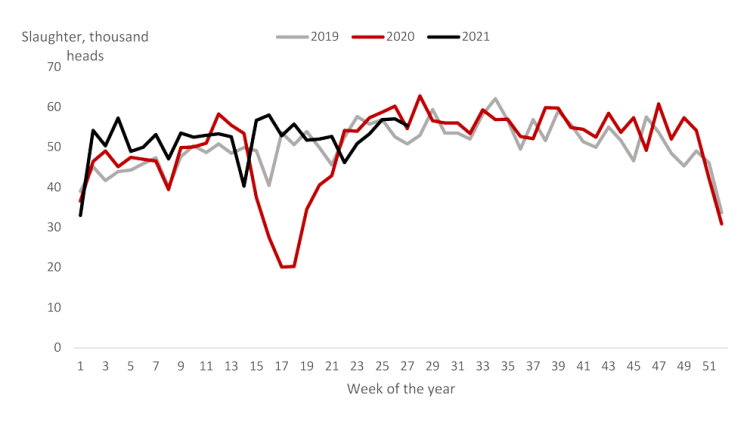

Cow-calf margins in Western Canada remain pressured due to high feed costs, low moisture levels and high temperatures. That has prompted increased marketings. Federally inspected slaughters show that slaughters in the first half of 2021 are 13.5% higher year-over-year (YoY) and 6.5% higher than 2019 (Figure 1). Losses are more likely as feed costs increase with diminishing feed supplies while cattle prices weaken as more cattle are slaughtered. Basis levels are expected to decline given increased culling and early marketing of yearlings.

Figure 1: Cattle slaughter in the West is following recent trends but may increase with early marketing

Source: Canfax.

The feedlot sector also faces significant hurdles given high feed costs and ample supplies of cattle coming to market. Alberta hay prices rose 25% between May and June 2021 and average Montana hay prices increased 50% between May and August 2021. Lethbridge feed barley prices hit a record $415 per tonne or $9.00 per bushel for the week ending July 30. Profitability for the feedlot sector is projected to remain below break-even.

The one bright spot is the stable strength of demand for red meat. The U.S. choice beef and pork cutout values show North American values have exceeded their respective five-year averages so far in 2021 (Figures 2 and 3), in no small part due to households’ greater savings and reduced spending on other consumption trends. Globally, beef and veal consumption are expected to rise by 1% YoY while pork consumption is expected to rise by 2.3% YoY, according to the OECD.

Figure 2: U.S. beef cutout values fall from 2020 high, but continue to outperform 5-year average

Source: USDA.

Figure 3: U.S. pork cutout values in 2021 easily exceed high values of 2020

Source: USDA.

Bottom line

Operations culling older cattle now will have a younger herd when moisture levels and temperatures improve, better positioning themselves to rebuild their herd. Assuming normal crop growing conditions, current profit projections indicate a return to profitability for the cow-calf sector in 2022.

Regardless of weather impacts in 2021, the red meat sectors may soon see diminished overall markets as China slows its purchases of red meat. Consumption of animal proteins has fallen with declining incomes throughout the rest of the world. In North America, that trend has not been seen, as households show continued pent-up demand for red meats in barbecue season and as the food service sector continues to improve. It will help in a year that has been anything but easy.

Martha Roberts

Economics Editor

Martha joined the Economics team in 2013, focusing on research insights about risk and success factors for agricultural producers and agri-businesses. She has 25 years’ experience conducting and communicating quantitative and qualitative research results to industry experts. Martha holds a Master of Sociology degree from Queen’s University in Kingston, Ontario and a Master of Fine Arts degree in non-fiction writing from the University of King’s College.