2021 Cattle and hog sectors outlook update: Hope for a strong end to the year amid high costs

This is the final update to our 2021 cattle and hogs outlook. Our grains, oilseeds and pulses outlook update was published two weeks ago, and the dairy outlook update was published last week. Next week, we’ll update the 2021 broiler outlook.

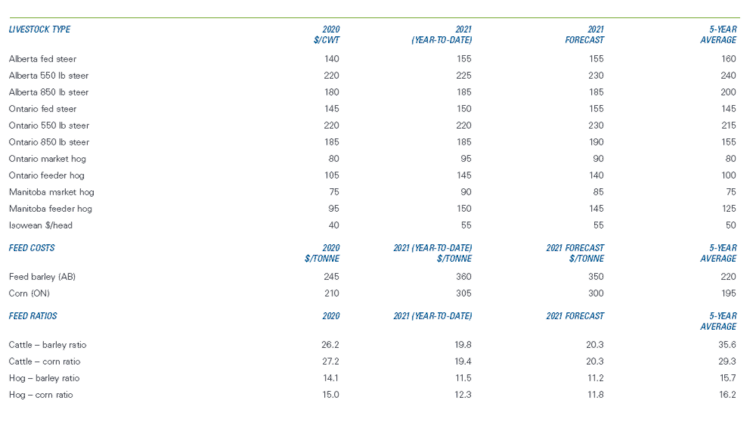

Our February forecasts provided livestock prices that have each been exceeded to date. Year-over-year (YoY) prices all show improvement (Table 1). Both cattle and hog prices in Eastern Canada are now above the five-year average. Western cattle are challenged to meet their five-year average in 2021, but year-to-date data show prices have generally risen since 2020.

Hog prices forecasted for the remainder of the outlook period are mostly expected to be lower than year-to-date levels. Average cattle prices for the rest of 2021 are largely consistent with the year-to-date average.

Table 1: Cattle and hog prices ($/cwt) expected to stay above 2020 prices for rest of 2021

Sources: Statistics Canada, AAFC, USDA, CanFax, CME Futures, and FCC calculations.

Those prices have played into a year of tight cow-calf margins in Western Canada. So have feed costs that were high in the summer and that continue to rise. Across much of the West, drought has negatively impacted pasture conditions, feed supply and water availability, challenging feedlot profitability. Cow-calf margins in eastern Canada are expected to be better given good growing conditions.

Feed ratios out of step with 5-year averages

The forecasted cattle-to-barley ratio for 2021 has fallen 24.8% YoY and 44.7% against the five-year average (Table 1). The hog-to-corn ratio has also deteriorated, falling 21.3% YoY and 27.2% against the five-year average.

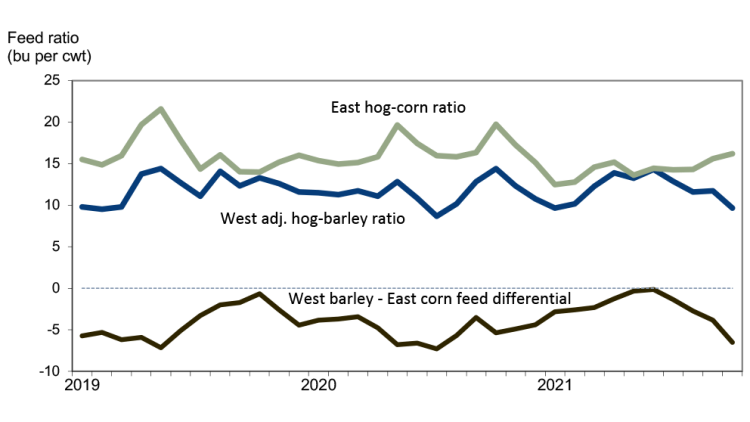

Most Canadian imports of U.S. corn are going to the West, where feedlots are facing barley costs projected for the year to be 42.9% higher YoY and 59.1% higher than the five-year average. Corn prices are no better. They’re also forecasted to be 42.9% higher YoY and 53.8% higher than the five-year average. That has generated a significant difference in Western and Eastern livestock-to-feed ratios (Figure 1), calculated as the number of bushels of Number 1 feed barley or corn equal in value to 100 lbs. of index live hog.

Figure 1: Gap in hog-feed ratios shows Eastern advantage

Sources: AAFC, USDA, and FCC calculations. The differential calculation is the West hog — barley ratio subtracted by the East hog — corn ratio.

Cattle slaughter

This summer’s major drought meant cattle producers from B.C. to northern Ontario were forced to find feed and forage from distant suppliers, helping to elevate already high feed costs. As water sources dried up throughout the prairies, slaughter rates picked up. For the year-to-date for the week ending October 16, cattle slaughters were up 9.3% YoY and 6.4% relative to 2019. Herd liquidation efforts in July and August helped alleviate pressures on margins in the short-run and have not resulted so far in materially lower domestic prices as global beef demand remains strong.

Export demand may outpace meat availability

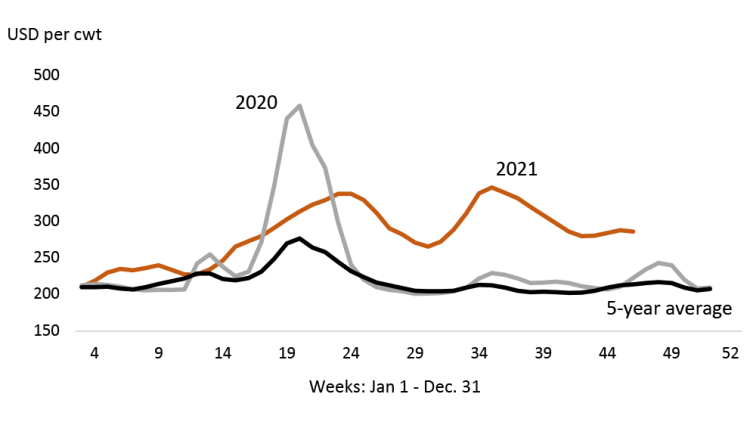

In February, we identified the demand for red meat as an important driver of profitability to Canada’s red meat sectors, and it has remained strong throughout the year. The U.S. choice beef and pork cutout values (a signal of consumer demand and industry supply) still stand well above their 5-year average values. As of the week ending November 5, the beef cutout value was 35.7% higher than the five-year average (Figure 2), having fallen from its high in August. The U.S. pork cutout value has also recently fallen from the two-year high in June (Figure 3) but remains 22.6% above the five-year average.

Figure 2: Despite the U.S. beef cutout value’s spring and fall dips, beef demand remains strong

Source: USDA.

Figure 3: U.S. pork cutout values in 2021 remain above 5-year average

Source: USDA.

China’s herd rebuilding outcomes after the African Swine Fever epidemic is a major driver of global meat demand. The USDA expects the world’s largest pork consumer to gradually import more in 2022. In 2021, they’re expected to import 5 million metric tons (MMt) of pork which is slightly below 2020’s pace when they imported a record 5.3 MMt. Although China’s demand is robust, there are questions about the strength of their economy amid significant inflationary pressures.

Beef exports may not keep pace with demand, as global production is expected to decline in 2021. That’s due, in part, to a 23-year low in Australia, where efforts are underway to rebuild their herd post-drought.

Across Asia, demand for beef is expected to remain strong and supporting prices to the end of the year. While China’s imports are expected to drop YoY in 2021, they’ll remain the world’s largest beef importer with 31.7% of projected imports.

Economics Editor

Martha joined the Economics team in 2013, focusing on research insights about risk and success factors for agricultural producers and agri-businesses. She has 25 years’ experience conducting and communicating quantitative and qualitative research results to industry experts. Martha holds a Master of Sociology degree from Queen’s University in Kingston, Ontario and a Master of Fine Arts degree in non-fiction writing from the University of King’s College.