2021 Grains, oilseeds, and pulses outlook update: Tight supply expected to push prices higher

This is the second of three quarterly updates to our 2021 Outlook for major crops published in February. Our annual outlooks for dairy, cattle and hogs and broilers will be updated over the next three weeks.

Our projected crop prices in May improved relative to our annual outlook in February. We’re again revising the price forecast for all crops upward. Expected Canadian production shortfalls, along with continued strength in demand from China for grains and oilseeds, drought concerns in the U.S. and tight global grain supplies have boosted prices for the 20-21 MY and 21-22 MY crops.

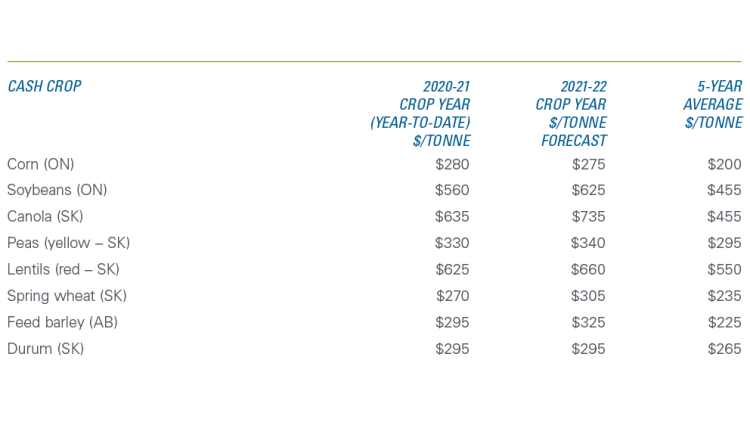

Several price trends are noteworthy as we’re coming quickly to the end of the 2020-21 crop year. First, prices for both the 2020-21 and 2021-22 crop years are considerably above the 5-year average (Table 1). And for all 2021-22 crops except corn, prices remain elevated year-over-year (YoY). According to the USDA’s most recent Grain: World Markets and Trade report, Canadian wheat prices are projected to rise to the highest in the world.

Table 1: Old and new crop prices continue to exceed early expectations

Source: FCC calculations

Those price increases will support profitability but rising production costs will help offset the gains in revenues. Input costs in eastern Canada in 2021 have risen 9.3% YoY and 13.9% over the 5-year average. Western Canadian costs have grown even more, increasing 13.4% YoY and 16% over the 5-year average. For some, it will be a moot point. With the excessive moisture concerns, producers may choose to reduce or abandon their applications altogether.

Falling yields will challenge profitability in the west

We closed out the May Outlook update cautioning that weather may be the most important factor to consider in forecasting profitability in 2021. We were right. Although the mid-summer crop outlook from AAFC didn’t capture the likely full impact of dry conditions on yields, the difference between 2020 and 2021 will be stark for many crops.

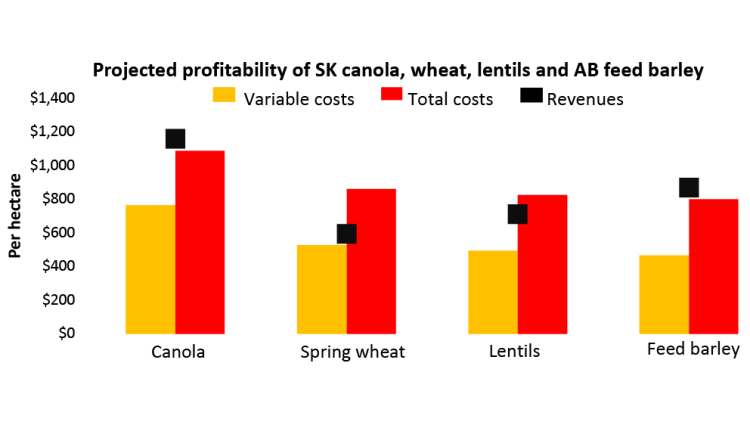

To evaluate the potential effects of the lack of moisture and high temperatures, we applied the historically largest divergence from yield trends to the 2021 crop. In 2002, widespread drought reduced Saskatchewan spring wheat yields by 47.6%, Saskatchewan canola yields by 30.6%, Saskatchewan lentils by 53.4%, and Alberta barley yields by 58.2%. Figure 1 shows the impact on revenues and profitability that similar divergences away from trends would have on the 21-22 crops.

Figure 1: A major divergence from trends in yields will weaken revenues, margins in 2021-22 MY

Source: FCC calculations

Conditions in western Canada are expected to have a significant impact on producer profitability. Should an average yield reduction of 35% occur, crop margins may fall below break-even. And while the average yield will be lower at the aggregate level in 2021, individual operations with little to no crop production will be hit even harder.

However, record-high canola and barley prices may still support positive margins despite the large decline in their expected yields. Plus, given the significant decline in the spring wheat crop conditions across North America, producers with high protein wheat may see increased premiums. Lentils may see positive margins with India’s recent reductions in tariffs to 10% and if yields don’t fall to near-record lows.

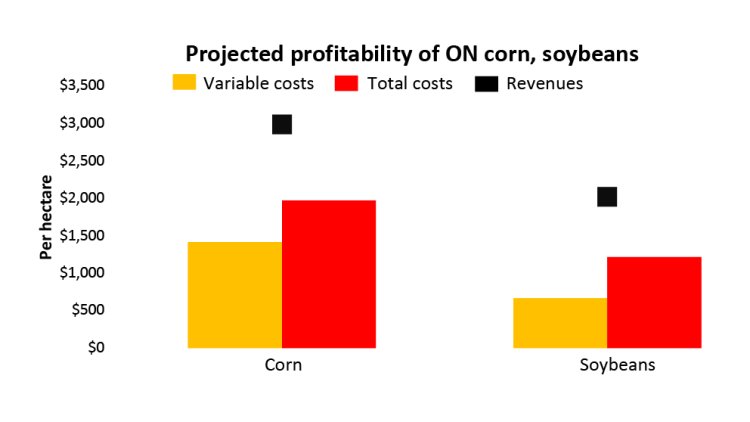

Figure 2: Positive corn and soybean profitability in Eastern Canada

Source: FCC calculations

We expect positive margins over the outlook period in 2021 across Eastern Canada, where yields aren’t likely to deviate from trends significantly (Figure 2). The USDA’s projections of 2021-22 global corn ending stocks are rising YoY but remain below 2019-20, as they are in the U.S. too. Although they’ve recently softened, soybean prices should continue to benefit from strong global demand.

Global demand for grains and oilseeds remains strong despite tight supplies

China’s total purchases of coarse grains have been astounding in the 2020-21 crop year, rising more than 150% YoY and pushing total global imports up 11.1%. Their wheat imports grew 95.2% over the same period.

Chinese imports of major crops during the 2021-22 MY are forecasted to remain at historical highs, which will continue to support prices and profitability for barley and corn. Global wheat imports (without China) are expected to grow 5.6% YoY, and global coarse grains (without China) are forecast to grow 2.8% YoY in the 2021-22 MY.

Chinese purchases of oilseeds have similarly upended global markets. Their 2020-21 soybean imports were stable after growth of 19.4% in 2019-20. In 2021-22, Chinese imports are expected to increase 3.9% YoY, while global imports (without China) are forecast up 2.8%.

Global demand for lentils in 2021-22 is expected to be like 2020-21 as India, the world’s largest importer, Bangladesh and the United Arab Emirates each increased imports in the first five months of 2021. Over that same period, Canada’s total exports fell 11% from the highs of the same period last crop year, but they remained 4.6% higher than the five-year average.

As Canadian stocks bottom out and prices soar, overall usage may drop

In Canada, total carryout stocks of all major crops in 2021 are expected to fall to their lowest levels in eight years. The deficits will only add to the woes of end users of field crops, pushing up the costs of their inputs from domestic suppliers. As production falters and prices rise to ration demand, exports and stocks are both likely to fall in the 21-22 MY, to at least near their lowest levels ever.

Bottom line

2020 was a year of record revenues for many. One year later, we may see records of a different sort. Last year's tight carry-in stocks due to large exports have tightened even further, pushing prices up past 2020 and possibly curtailing overall usage later. Global demand remains strong, applying further pressure on stocks. But the biggest hurdle – and question – for Canadian producers now is yields. We have yet to see how badly the dryness and heat that have gripped the prairies will reduce them.

For help with your operation, please reach out to your FCC Relationship Manager.

Martha Roberts

Economics Editor

Martha joined the Economics team in 2013, focusing on research insights about risk and success factors for agricultural producers and agri-businesses. She has 25 years’ experience conducting and communicating quantitative and qualitative research results to industry experts. Martha holds a Master of Sociology degree from Queen’s University in Kingston, Ontario and a Master of Fine Arts degree in non-fiction writing from the University of King’s College.