2022 Dairy outlook update: Lower world prices challenge profitability

This is the last quarterly update to our 2022 Outlook for Canada’s Dairy Sector, published in January. Last week we updated our Grains, Oilseeds, and Pulses Outlook. Next week, we’ll update the outlooks for cattle and hogs.

World prices for ag commodities have dropped from their peaks earlier this year, lowering feed costs to dairy farmers. However, world dairy prices have also declined. Since peaking in Q2, world prices for non-fat dry milk have dropped by about 10%. That matters because although Canada operates under a supply management system, farmgate prices are not insulated from world prices. The good news is that the decline in the loonie relative to the greenback has softened the impacts.

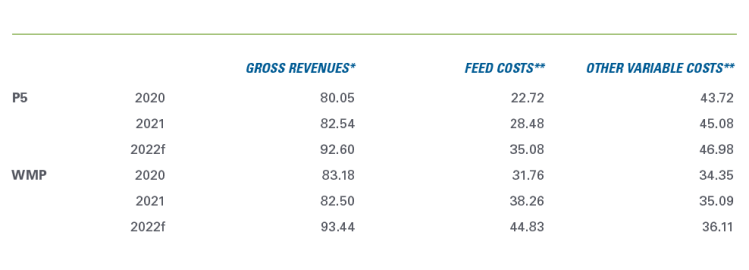

Table 1 summarizes revenue and cost data for 2020 and 2021 and our latest forecasts for 2022. Since our May outlook update, we’ve revised upward our estimates of gross revenues for P5 (Eastern provinces), but revised slightly downward for Western Milk Pool (WMP) farmers. The latest cost estimates for the P5 incorporate the most recent data from the Canadian Dairy Commission, contributing to lower estimated costs. For the WMP, cost estimates are based on Alberta Dairy Cost Study. We forecast lower feed costs and other variable costs for WMP farmers. The table does not include forecasts for capital costs, but we note that interest rates have increased throughout the year and are expected to increase further.

Table 1: Estimates of dairy revenues and costs ($/hl)

Sources: Calculations by FCC are based on cost of production estimates from the Canadian Dairy Commission and Government of Alberta and data from the Dairy Farmers of Ontario, Les Producteurs de Lait du Quebec, Alberta Milk, Statistics Canada and USDA.

*Gross revenues are based on data reported by producer groups, which differ from Statistics Canada data used in calculating dairy receipts.

**The calculations use different definitions of cost categories for the P5 and WMP, values are not directly comparable.

The P5 announced a 2% increase in the production quota effective October 1, motivated by expected low butter stocks for the end of 2022 and throughout 2023. The WMP has not announced an increase in production quota.

A 2.5% increase in the farmgate milk price became effective on September 1. The Canadian Dairy Commission (CDC) will soon propose the price adjustment that will take effect on February 1, 2023. The September increase will be deducted from the February adjustment. The CDC adjusts the farmgate price equally, considering changes in production costs and inflation, which grew by 2.2% and 7.0% (August 2022) respectively.

Trends to watch in the last quarter of 2022

1. Production costs

The CDC’s indexed cost of production study shows that production costs increased by 2.2% between Summers 2021 and 2022. Comparing August 2021 and 2022, the study finds notable increases in costs for transportation, energy and interest paid and decreases in direct labour and custom work costs.

Going forward, we expect grain prices to stay below their 2022 peaks but to remain well above their 5-year averages. In the East, corn prices for the 2022-23 crop should slightly exceed those for the 2021-22 crop. In the West, feed barley prices will significantly decline for the 2022-23 crop compared to the 2021-22 crop.

Prices for gasoline and diesel have continued dropping but whether this will continue is uncertain given the geopolitical environment. Fertilizers prices are likely to increase although at a slower pace than last year. With labour shortages and high inflation, wages will continue to grow. In the long term, we expect the market for workers to stay tight.

2. Demand for dairy products to remain robust despite financial squeeze

With wages increasing slower than inflation, real estate prices dropping and stock markets down, households are less financially secure. That may affect the demand for milk and dairy products, but evidence shows dairy products are necessary goods, and their consumption isn’t largely impacted by income.

August inflation data shows Canadian butter prices increased 16.9% year-over-year (YoY) compared to 6.3% for cheese, 7.9% for fresh milk and 7.0% for dairy products. Given that the demand for dairy products isn’t price-sensitive and that prices for competing protein products have also increased, higher prices for dairy products may not significantly impact their consumption.

Globally, there are signs that the demand for dairy products might have weakened. Indeed, as mentioned at the outset, prices for non-fat dry milk have dropped by more than 10% from their year highs. We can point to a few contributing factors: China has been importing fewer dairy products and a general decline in ag commodity prices. Lower expected global economic growth may also be playing a role.

3. U.S. dairy product imports likely to fall but imports from Europe to grow

Growth in the value of dairy product imports continue, but, as mentioned in the previous update, it largely reflects price inflation. So far, in 2022, total import volumes of dairy products under HS chapter 04 are in line with those in 2021. However, the YoY import mix includes more products under HS 0403 (which includes buttermilk) and HS 0406 (cheese and curd) and fewer products under HS 0401 (milk and cream, not concentrated).

The Canadian dollar has lost about 7% to the U.S. dollar since the start of the year. This makes U.S. dairy products less competitive in the Canadian market and thus reduces our imports. Compared to other currencies, the loonie has performed well, gaining more than 7% to the Euro, 14% vis-a-vis the British pound and 11% to the New Zealand dollar. This raises the prospect of seeing more imports of cheese from Europe and butter from New Zealand.

4. Macroeconomic conditions

Inflation hit 7% in August, down from the previous months thanks to lower energy prices. The Bank of Canada has increased the overnight interest rate (OIR) by 3% in 2022. With inflation still a factor, we expect the Bank will increase the OIR by another 0.75% before the end of the year.

For more information on the macroeconomic environment, check out our Economic and Financial Market Update on December 6.

Article by: Sébastien Pouliot, Principal Economist