2022 Grains, oilseeds, and pulses outlook update: Prices soar due to war in Ukraine

This is the first of three quarterly updates to our 2022 Outlook for major crops published in January. Over the next two weeks, we’ll update the Outlooks for dairy and cattle and hog.

Despite recent events, major trends to monitor in 2022 have not changed: inflationary pressure on input prices, geopolitical tensions, and global trade; that said, the Russian invasion of Ukraine has changed how we need to analyze these trends and manage the risks associated with them.

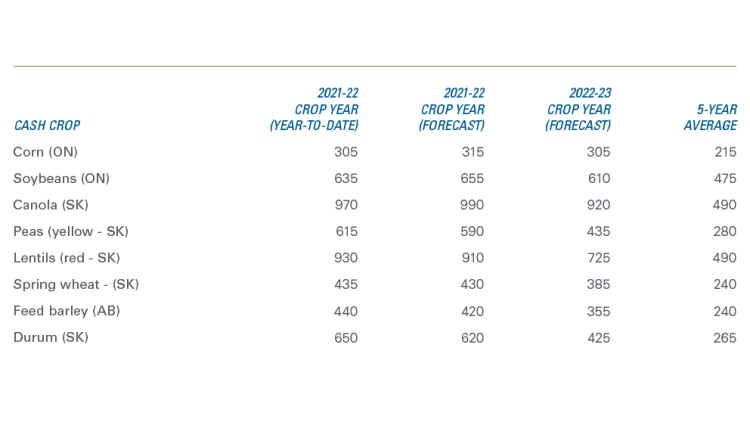

Our current forecasts show prices will remain strong for the rest of the marketing year (Table 1). Some prices will ease off their recent highs, while canola, corn and soybean prices should increase. Recent news from the US on the decision to extend the usage of E15 gasoline this summer provides an additional boost to corn prices.

Table 1: Old and new crop prices ($/tonne) continue to exceed early expectations

Source: FCC calculations.

Ag commodities prices continue to rise

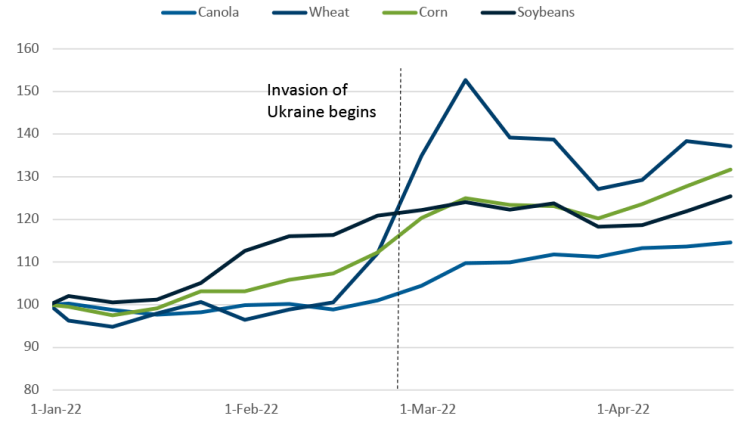

The invasion plunged global grain markets into a state of chaos. As we highlighted in early March, Ukraine and Russia are major exporters of many grains and oilseeds, particularly wheat, corn, rapeseed/canola and sunflower oil. Western sanctions and logistics issues are limiting old crop exports from these regions. The war raises many questions about the new crop: how many acres can be seeded this spring? If seeded, how much will be available to harvest? Will producers be able to get harvest completed? Without answers to these questions, combined with uncertainty about input and labour availability, it is understandable why ag commodity markets have been so volatile. The situation has left traditional buyers of Ukrainian and Russian commodities scrambling for alternative suppliers, causing prices to surge.

Markets have settled since then, but prices for traded commodities are still much higher than at the beginning of the year. Futures prices for wheat and corn are up 37 % and 32%, respectively (Figure 1).

Figure 1: Futures prices up across the board (indexed to January 1, 2022 = 100)

Sources: Barchart and FCC calculations.

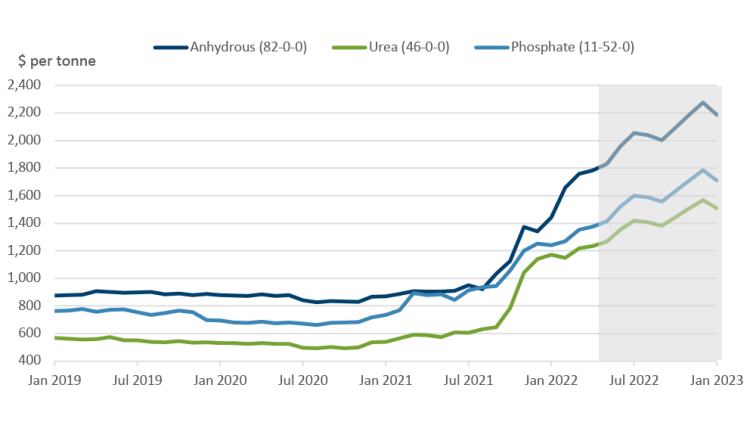

Input prices are up

Of course, revenue is only one part of the profitability equation. Input prices continue to march upward. Fertilizer prices were inflated before the invasion due to various disruptions from the pandemic and China’s move to curb fertilizer and food inflation by limiting its fertilizer exports. Anhydrous, urea and phosphate fertilizer prices increased 56%, 85% and 32%, respectively, this marketing year before the invasion (August to January).

The invasion of Ukraine added pressure to the fertilizer market. In 2021, Russia was the leading exporter of nitrogen fertilizer and the second-leading exporter of potassium and phosphate fertilizers. Belarus, a Russian ally also the subject of sanctions, was the third-largest exporter of potassium. From January to March, anhydrous, urea and phosphate fertilizer prices increased another 22%, 4% and 9%, respectively. But potash prices – after staying stable from August to January – jumped 155% from January to March. Economic sanctions on Russia are more heavily impacting fertilizer imports in Eastern Canada as it’s more dependent on fertilizers from that country, in particular nitrogen, and there is limited on-farm fertilizer storage in Eastern Canada.

Our forecast models show no slowdown in fertilizer prices growth. Average prices for the summer (May to August) will be 12-15% higher than March levels (Figure 2).

Figure 2: Fertilizer prices continue to soar

Sources: Alberta Agriculture and Forestry and FCC economics.

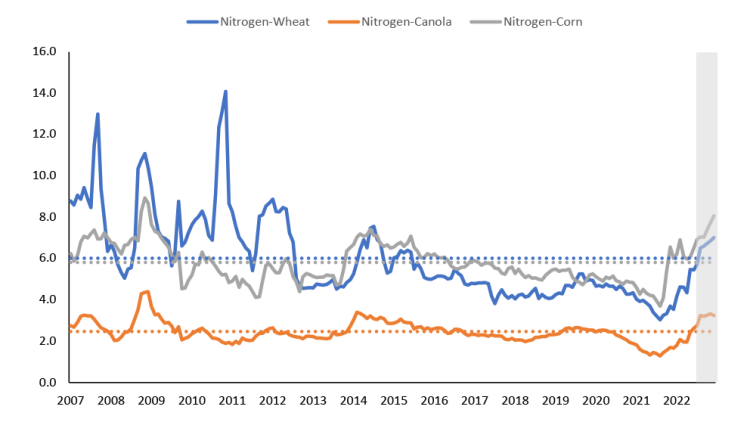

Fertilizer affordability, calculated by the price of fertilizer divided by the crop price, has recently deteriorated. The higher the ratio, the less affordable fertilizer becomes relative to crop revenue. The ratios for wheat, canola and corn are near their respective long-run averages and are expected to increase slightly for the remainder of the year (Figure 3). If correct, this would put the ratios in line with where they were between 2014 and 2015.

Figure 3: Fertilizer-price ratios are at or below historical averages, but could go higher

Sources: Alberta farm input prices, ICE and CME futures, and FCC calculations.

Crops expected to remain profitable

On the one hand, we have higher crop prices, but on the other hand, we have higher input prices. What’s the net impact on expected profitability for the 2022-23 crops?

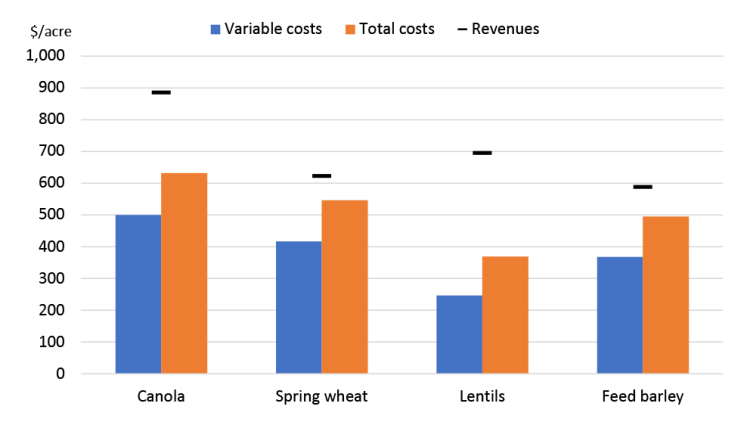

Soil moisture will be key this year following the 2021 drought. Drought conditions have improved since the fall, but large areas in the Prairies remain under severe or extreme drought. The situation has improved in Manitoba and most of Eastern Saskatchewan, while it is still dire in Southwestern Saskatchewan and Southeastern Alberta. Assuming trend yields, crops will be profitable in the next marketing year (Figure 4), and there is room to accommodate lower yields and maintaining profitability. We find that it takes about a 15% yield reduction for profits per acre for spring wheat to be negative.

Figure 4: Projected profitability of selected Western crops

Source: FCC calculations.

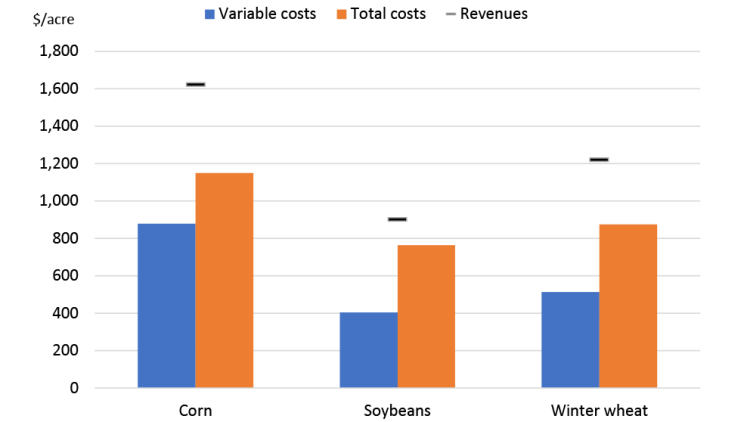

In Eastern Canada, moisture is plentiful in most areas, but the cold and wet spring is keeping tractors off the fields and slowing down work. There is ample time to catch up, however. We expect strong profitability for Eastern crops under normal growing conditions. We are keeping an eye on fertilizer and pesticide prices and the availability of these inputs, which could be an issue for some farms.

Figure 5: Projected profitability of selected Eastern crops

Source: FCC calculations.

What to expect going forward

Forecasting when and how the war will end is nearly impossible, but the longer it continues, the more global trading patterns will shift. New challenges — and opportunities — will emerge. Managing expenses, including input prices and debt servicing costs in the context of rising interest rates, will allow the ag industry to take advantage of these emerging opportunities. Global stock-to-use ratios were stable prior to the invasion, but the disruption the war created will test supplies in 2022-23. Canada is positioned to play an important role in meeting global demand for wheat, canola, and barley, assuming the drought subsides. Indeed, the most important variable in the short-term in how the 2022 growing season will unfold is the weather, particularly moisture levels in the prairies.

Senior Economist

Graeme Crosbie is a senior economist at FCC. His focus areas include macroeconomic analysis and insights and monitoring and analyzing Canada’s food and beverage industries. Having grown up on a dairy farm in southern Saskatchewan, he occasionally comments on the health of the dairy industry in Canada.

Graeme has been at FCC since 2013, spending most of that time in risk management. Graeme holds a master of science in financial economics from Cardiff University and is a CFA charter holder.