2023 upward trends in farmland values suggest a resilient market

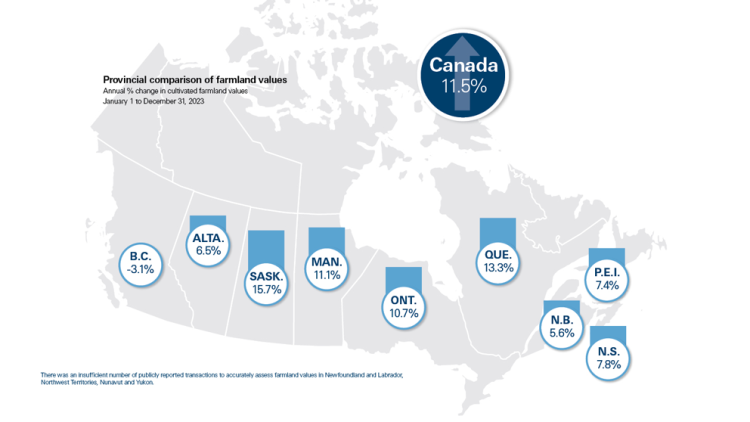

Economic conditions in the agriculture sector worsened throughout 2023. Canadian field crop production declined in 2023 due to drought conditions in Western Canada along with overall pressures on commodity prices. Input costs and interest rates remained high, resulting in tightening profit margins. Yet FCC is reporting an average increase of 11.5% in cultivated land values for Canada in 2023, the second highest increase since 2014, and slightly below the average growth recorded last year. This post summarizes provincial trends observed in cultivated land, and the full FCC Farmland Values Report also presents provincial and regional trends in irrigated land and pastureland values.

Provincial trends

Our analysis covers the period of January 1 to December 31, 2023. The highest reported increase in average farmland values was in Saskatchewan at 15.7%, followed by Quebec at 13.3% with Manitoba rounding out the top three at 11.1% (Figure 1).

All other provinces were below the national average: Ontario’s average was 10.7%, Nova Scotia reported 7.8%, P.E.I. recorded an increase of 7.4%, Alberta’s growth stood at 6.5% and New Brunswick had growth of 5.6%.

For the first time in recent years, we are publishing a provincial decline with British Columbia recording an average decrease of 3.1%. This province is where we find the highest per acre values in the country, and the largest decreases in values were observed in regions of the province with the highest per acre value.

Figure 1: Average cultivated farmland value changes for 2023

Source : FCC calculations

Cash on hand stimulates growth

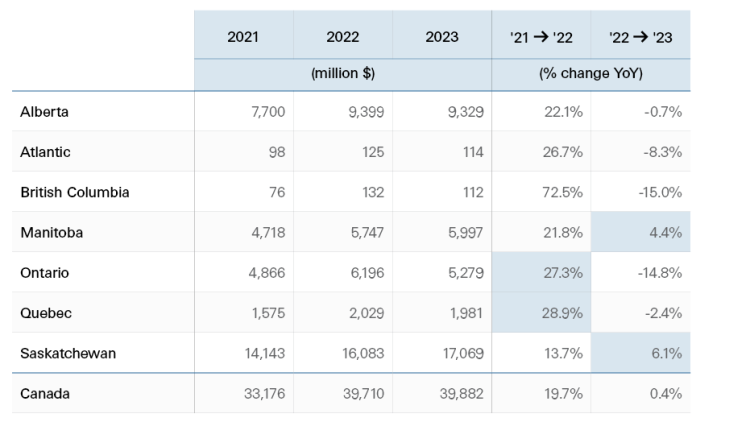

Statistics Canada reports that total field crop receipts recorded the strongest growth between 2022 and 2023 in Saskatchewan (6.1%) and Manitoba (4.4%) (Table 1). The largest appreciation reported between 2021 and 2022 was in Quebec and Ontario at 28.9% and 27.3%, respectively. These four provinces led the country in farmland value appreciation in 2023. This positive correlation between receipts and land value appreciation suggests that liquidities lead to stronger purchasing power and higher demand for farmland.

Table 1: Total field crop receipts (including deferred grain receipts)

Sources: Statistics Canada, FCC Calculations

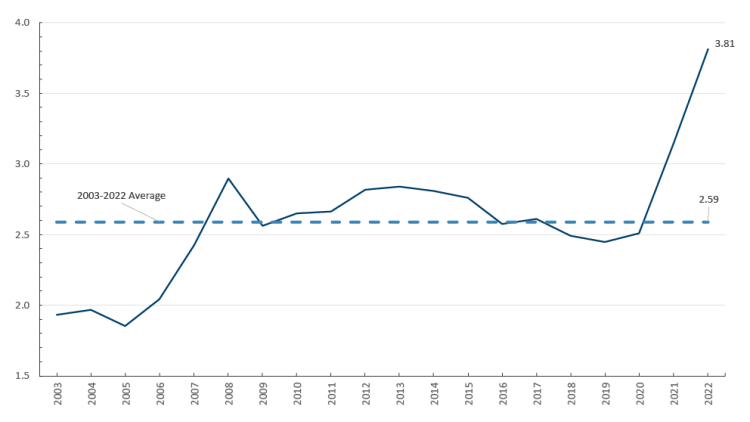

The average current ratio of these four provinces climbed from 2020 to 2022 (Figure 2). At the end of 2022, it stood significantly above the average of the last 20 years. Farm operations overall were in a strong position to meet financial obligations as current assets far exceeded current liabilities. The balance of Canadian agriculture in 2023 likely deteriorated because of lower commodity prices, weaker yields in the Prairie provinces and elevated interest rates and input costs (2023 data will be released later this year). Yet the trend prior to 2023 suggests that the robust financial health of Canadian agriculture can be supportive of the demand for farmland. Strong demand for farmland combined with a tight supply of farmland available explains the strong increases in values.

Figure 2: Average current ratio of SK, MB, ON & QC

Sources: Statistics Canada, FCC Calculations

Looking forward to 2024

The farmland market posted on average another year of solid growth last year, with 2024 having the potential to be a pivotal year. Profit margins for grain, oilseed and pulse operations are expected to be tighter than the most recent five-year average. While the Bank of Canada is likely to bring its policy interest rate down in the second half of the year, borrowing costs will remain elevated. Against this economic backdrop, our upcoming blog on March 27 will investigate the deterioration in the affordability of farmland.

Article by: Corbin Chau, Data Analyst, Valuations