2023 Food and Beverage Report: Mid-year update

Six months after our 2023 Food and Beverage Report was published, we look at how food and beverage manufacturers have performed so far this year, provide forecasts for the remainder of 2023 and early 2024, and highlight trends to watch moving forward.

Sales update

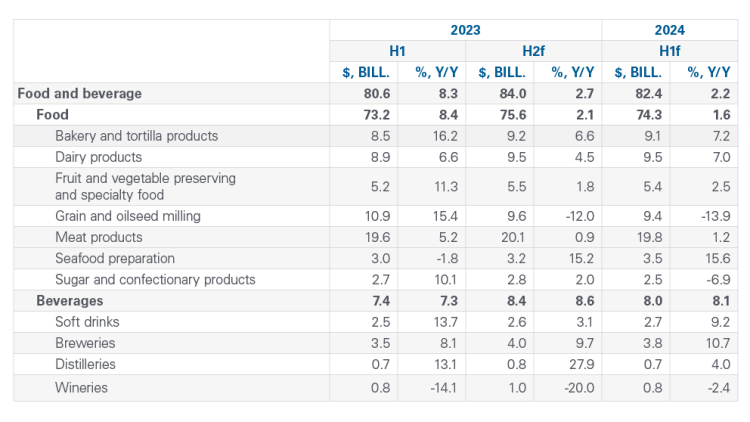

Sales numbers for the first half of 2023 (H1) were steady, with an increase of 8.4% for food manufacturing and 7.3% for beverage manufacturing compared to the same period in 2022 (Table 1).

Table 1: Food manufacturing sales are up in the first half of 2023, with growth rate likely to slow in the second half

Sources: Statistics Canada, FCC Economics

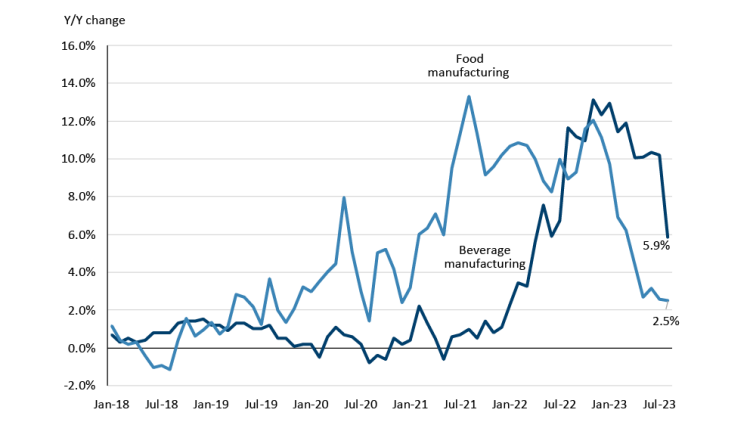

These are nominal sales numbers, meaning they do not account for inflation. Nominal sales growth can largely be attributed to the increase in the average manufacturing selling price as measured by the Industrial Product Price Index (IPPI). Until August, manufacturers’ selling prices for beverages had been running at over 10% growth Y/Y for months. In contrast, food manufacturing selling prices — which rose steeply during the pandemic due to increased demand and elevated input costs — have more recently been decelerating, with the August number coming in at just 2.5% Y/Y, the lowest growth rate in over two years. When accounting for inflation, growth for food manufacturers in H1 was 1.0% and -2.6% for beverage manufacturers.

Figure 1: Selling prices for food manufacturers are cooling, remain high for beverage manufacturers

Source: Statistics Canada, FCC Economics

Considering the large increase in nominal sales in H1, we see 2023 sales for the food and beverage sector at $164 billion (5.4% growth), an increase from our estimated 2.2% in the Food and Beverage Report.

The food and beverage manufacturing industries are diverse, and the numbers in Table 1 reflect that. Though many sectors experienced double-digit sales growth, as noted above, much of that growth has come from higher prices. Grain and oilseed milling sales are forecast to decline in H2 2023 and H1 2024 because of an easing in prices for wheat and canola relative to the highs witnessed in 2022. Winery sales are down, but it’s noteworthy that this sector experienced a mini-boom in sales during the pandemic, with 25% and 32% growth rates in 2020 and 2021, respectively. Winery sales are still forecast to be 40% higher this year than in 2019, with increased volumes driving most of the growth, given manufacturers’ selling prices have only increased 14%.

Margins are looking to be lower in 2023

Food and beverage manufacturing margins have been under pressure since 2019, and 2023 will be no different. While margins were compressed in 2021 and early 2022 because of rising input costs, they were/are now under pressure from the demand side of the equation, with real consumer spending declining due to higher inflation. Beverage margins will struggle more than food, with margins nearly 50% lower than in our base year 2019 (Figure 2). Note that margins can vary greatly by sector.

Figure 2: Food and beverage manufacturing gross margins under pressure in 2023

Sources: FCC Economics, Statistics Canada

Trends to watch

Softening labour markets

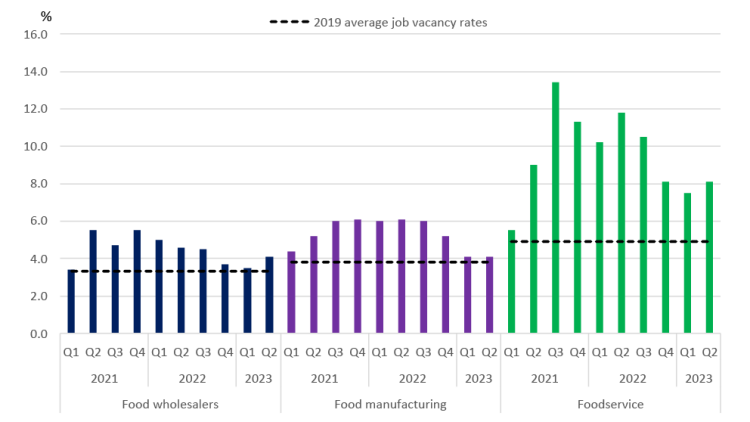

The job vacancy rate (the number of vacant positions as a percentage of labour demand) for food wholesalers, food manufacturers, and foodservices operations has been declining since 2021/22, and the rates for food manufacturing and food wholesalers are in line with pre-pandemic averages. These declines are a result of vacant positions being filled, firms no longer looking to hire as they were before, or both.

Figure 3: Job vacancy rates in key food sectors on the decline

Sources: FCC Economics, Statistics Canada

Wage growth remains an issue for employers. For food manufacturers, the average annual increase in weekly earnings of employees from 2015 to 2019 was 0.8% per year, but in the last two years, average weekly wages have grown 4.6% per year. Job vacancy rates and wage growth are correlated, so with an easing in the former, we should see some deceleration in the latter.

Foodservice demand

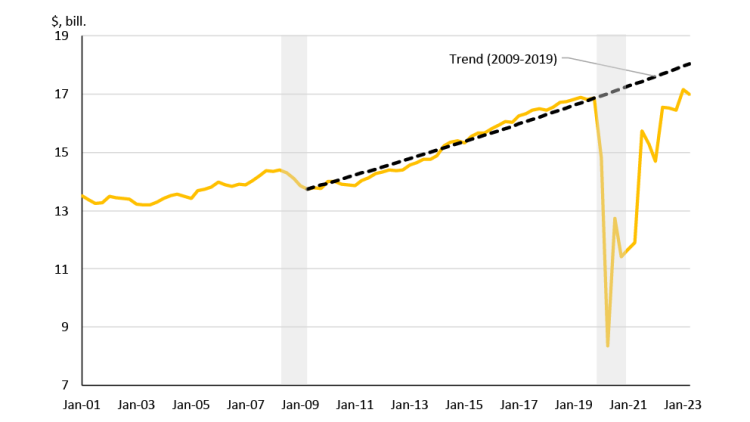

It took a while, but earlier this year, real (i.e., inflation-adjusted) spending on food services returned to pre-pandemic levels (Figure 4). While this is a positive sign, spending is well below the pre-pandemic trend from 2009 to 2019.

With an economic slowdown occurring and likely negative repercussions on the labour market, this type of discretionary spending will struggle to grow. It could even contract if the slowdown turns into a recession. Here, we can look at history to gain some insights. The recession of 2020 is difficult to utilize in this analysis, given the lockdowns caused a dramatic decrease in foodservice sales. However, during the recession of 2008-09, we saw a decrease of 4.6% in foodservice sales.

Figure 4: Inflation-adjusted foodservice sales back to pre-pandemic levels but below pre-pandemic trend

Sources: FCC Economics, Statistics Canada

Shaded areas indicate recessions. Data are quarterly

Slowing global economic growth

Exports are still strong in 2023, though lower than the last two years. Food manufacturing exports are up 8.8% Y/Y in H1 2023 after solid performances in 2022 (14.6%) and 2021 (17.1%). Any global slowdown — particularly in the US, Canada’s largest agri-food trading partner — will impact export sales opportunities.

Senior Economist

Graeme Crosbie is a senior economist at FCC. His focus areas include macroeconomic analysis and insights and monitoring and analyzing Canada’s food and beverage industries. Having grown up on a dairy farm in southern Saskatchewan, he occasionally comments on the health of the dairy industry in Canada.

Graeme has been at FCC since 2013, spending most of that time in risk management. Graeme holds a master of science in financial economics from Cardiff University and is a CFA charter holder.