2024 Dairy outlook update: a turnaround year for producers

A string of positive events has occurred this year for the dairy industry, which is a welcome relief to producers who have recently, on the whole, endured multiple tighter-than-normal years. Simply put, there is optimism in the industry today that has not existed for some time.

Primarily as a result of lower-than-expected feed costs, due to favourable weather and strong production south of the border, our gross margin estimates for both the P5 (eastern Canada) and WMP (western Canada) have improved since our original forecast in February (Table 1).

Table 1: Changes in estimates of average gross dairy margins ($/hl), 2024*

*The calculations use different definitions of cost categories for the P5 and WMP and therefore values are not directly comparable.

**Income is primarily the milk price but also includes net cattle sales, inventory adjustments and miscellaneous receipts.

***Gross margin is total revenue less variable costs and feed. Fixed costs and return to management are excluded from the calculation. We do not include fixed costs as these vary greatly between operations.

Sources: Statistics Canada, Canadian Dairy Commission, Government of Alberta, FCC Economics

Demand for dairy products surges

In our February outlook we highlighted the reasons we believed multiple incentive day announcements were likely forthcoming in 2024. This has certainly turned out to be the case. In the P5, 11 incentive days were granted (or are currently planned) this year. Even P5 organic producers – who, by our count, haven��’t had an incentive day since December 2022 – have been allocated eight incentive days this fall. Producers in the P5 also received a 1% quota increase effective September 1. In the WMP, there have been seven incentive days announced for the year alongside a 2% quota increase effective September 1. This is in addition to the quota increases that took effect in February earlier this year.

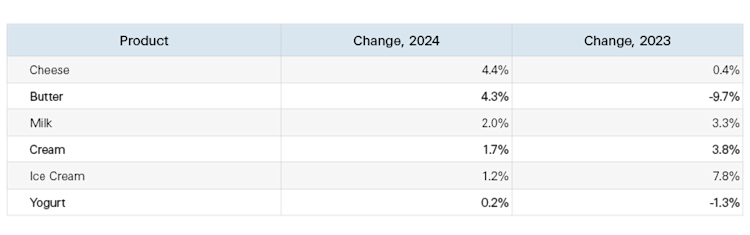

These levers being pulled to increase production are a result of strong consumer demand (Table 2). Our dairy product manufacturing outlook forecasts strong growth in the production of dairy products this year, and to-date sales have been strong. Indeed, when adjusting for inflation, sales of Canadian-produced dairy products are on pace to be the highest in over a decade. Consumption across all major dairy product types is up year-to-date, led by growth in cheese and butter.

Table 2: Changes in consumption by product, 2024 and 2023, year-to-date*

*January to July of each year. Unit of measurement for milk and cream are million litres. For all others, tonnes.

Sources: CDC, FCC Economics

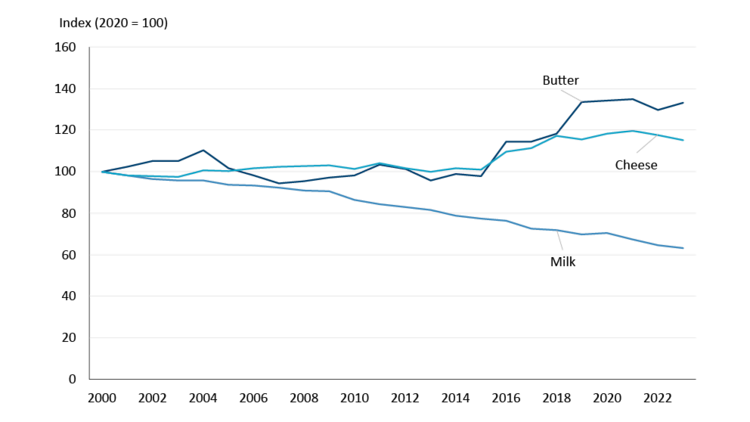

While much of this growth is a result of population growth, increases in per capita consumption are boosting demand as well. Taking the longer view, we can see per capita consumption of butter (33%) and cheese (15%) are up since 2000 while per capita consumption for fluid milk is down (- 37%) (Figure 1).

Figure 1: Changes per capita consumption* of select dairy products, 2000 to 2023

*Consumption is measured as the food that is available for consumption at retail.

Sources: Statistics Canada, FCC Economics

Butter stocks are still low heading into the fall, a period when stocks are historically drawn down to meet seasonal demand (e.g., holiday baking). It would not be surprising to see more announcements regarding production increases sometime in the next couple months.

Imports unlikely – or unable – to meet growing demand

This additional demand is likely to be met through increased domestic production rather than additional imports, given that some negotiated limits on foreign products are now capped and there is very little room for imports to increase.

Cheese imports under Canada-European Union Comprehensive Economic and Trade Agreement (CETA) are now capped and last year only 8% (1,400 mt) of allocated tariff- rate quotas (TRQ) for cheese went unfilled. So, while there is room for additional 1,400 mt of cheese to come in from Europe, that only represents approximately 0.2% of Canada’s annual cheese consumption.

Butter imports under the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) were 99% filled last year. However, the accelerated phase-in period with this trade deal has concluded, meaning tariff-free limits of imports will only grow marginally from this point forward. For example, for the 2024-25 dairy year, the TRQ limit for butter is increasing by only 45 mt (1.0%). It’s true that there’s room for cheese imports under CPTPP to grow but historically, imports under this agreement have been well below the tariff-free limit even when those limits were much lower than they are today.

Butter and cream imports under the Canada-United States-Mexico Agreement (CUSMA) were lower in 2023-24 than they were in 2022-23. That’s likely due to lower production in the U.S. amid its strong export volumes to other countries.

Spring rains, other factors bring relief and drive optimism

As mentioned, feed costs have eased significantly in 2024. Corn prices are down on expectations of another strong year of North American production, including an estimated record U.S. corn yield. Lower corn prices are putting downward pressure on feed wheat prices as well.

In the west, plentiful spring rainfall provided a bountiful first cut. Although July’s dry weather lowered potential yields for grain production, overall the year brought relief to producers that have struggled to secure adequate feed over the last few years. While data are scarce, qualitative insights from provincial crop reports offer reasons to be optimistic about feed availability.

There are more reasons for optimism than those outlined above that we just simply don’t have the space to write about. Culled cow and calf prices have been at record highs for most of year and, although they’ve fallen recently, should remain well supported given tight cattle supplies are expected for the foreseeable future. U.S. milk prices have been on an absolute tear since April, blowing past the USDA’s forecast from earlier in the year (recall that approximately 15% of the Canadian blended price is derived from U.S. prices). Additionally, interest rates have fallen in recent months and are expected to continue to fall into 2025 which will improve cash flow.

Bottom line

Overall, 2024 has shaped up to be a year of better results than the sector has seen in recent memory. Strong demand, better feed production and lower feed costs, and a handful of other factors at play are the reasons why.

What’s in store for next year? One thing we know is that farmgate milk prices are unlikely to receive a boost given slowing inflation and falling costs of production (an official announcement on 2025 support prices will happen no later than November 1). We’ll have more to come on that – stay tuned for our 2025 dairy outlook!

Graeme Crosbie

Senior Economist

Graeme Crosbie is a Senior Economist at FCC. He focuses on macroeconomic analysis and insights, as well as monitoring and analyzing trends within the dairy and poultry sectors. With his expertise and experience in model development, he generates forecasts of the wider agriculture operating environment, helping FCC customers and staff monitor risks and identify opportunities.

Graeme has been at FCC since 2013, spending time in marketing and risk management before joining the economics team in 2021. He holds a master of science in financial economics from Cardiff University and is a CFA charter holder.