2024 farmland values in Canada: Continued, steady growth

The national average farmland value increased 9.3% in 2024. This represents a slower pace of appreciation than in 2023, but remains higher than the average of the last 5 years (8.6%) and of the last 10 years (9.1%). This post summarizes the changes in values for cultivated land, irrigated land and pastureland. The full FCC Farmland Values Report also presents provincial and regional trends in each of these land types.

Provincial Trends

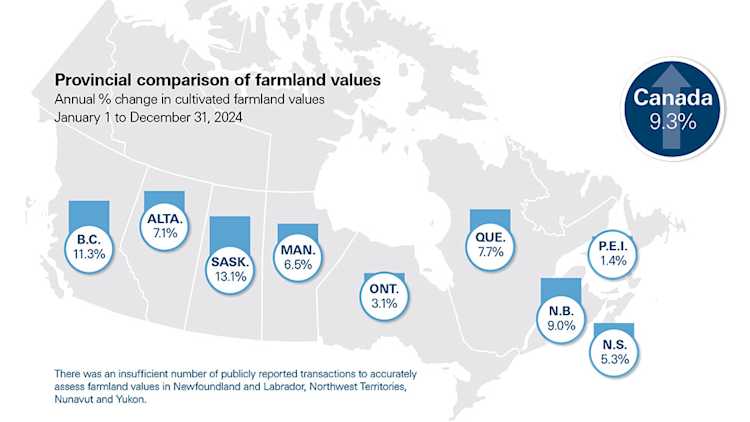

Our analysis covers the period of January 1 to December 31, 2024. The highest reported increase in average farmland values was in Saskatchewan at 13.1%, followed by British Columbia at 11.3% with New Brunswick rounding out the top three at 9.0% (Figure 1). All other provinces recorded an increase below the national average. Note that we use a weighted average approach when calculating the national percentage change in the average farmland value. As Saskatchewan is home to the highest number of cultivated acres, it represents the single largest contributor to the national average. Alberta and Manitoba carry the second and third largest weights, respectively.

Figure 1: Average Cultivated Farmland Value Changes for 2024

Source: FCC calculations

Profitability pressures emerge, but aren’t enough to weaken the demand for farmland

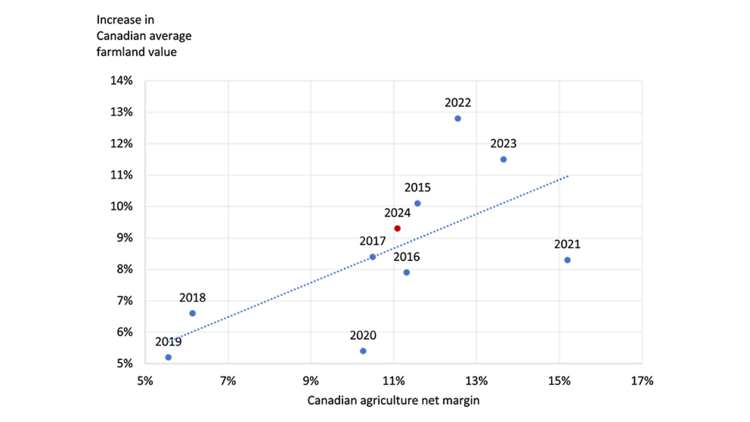

Profitability at the farm level is understandably and inextricably linked to farm operations’ willingness and ability to purchase farmland. Figure 2 provides some illustration of this correlation. The period 2018-2020 is when the smallest increases in average farmland values were recorded over the least 10 years. This period is also associated with the smallest agriculture net margins defined as the difference between farm cash receipts (FCR) and costs (expressed in percent of FCR).

Although not necessarily apparent from figure 2 is the fact that a strong net margin in agriculture in a given year increases the likelihood of recording a strong increase in average farmland values in the following year.

Figure 2: Canada’s National Farmland Value (FLV) growth rate vs. Canadian agricultural net margins

Sources: Statistics Canada, FCC Calculations

There are obviously various other factors that explain farmland values. Interest rates are a primary driver of the demand for farmland. Borrowing costs started to decline in 2024 as the Bank of Canada implemented cuts to its policy rate starting in June. But they remained, on average, elevated relative to previous years. The supply of available farmland remains tight, which, when combined with a robust demand, contributed to the lift in farmland values.

Irrigated and Pastureland Values in Canada

Average values of irrigated land in Western Canada have increased in all regions. Manitoba reported the highest rate of growth in 2023 at 18.1% but the province’s market now takes fourth place in 2024 with an annual growth rate of 3.5%. Saskatchewan experienced the largest growth rate at 25.8%. Alberta reported an 8.6% increase in average irrigated land values and British Columbia increased by 4.4%. Irrigated land continues to be in high demand, especially in drier parts of the Prairie provinces. Development projects like the Westside Irrigation Rehabilitation Project are becoming increasingly important in places that have experienced drought conditions in recent years.

Average pastureland values, across all four provinces, grew at a slower rate in 2024 than they did in 2023. This year, British Columbia reported a slight increase of 1.1% while Alberta had a 4.6% change in average values. Manitoba saw values rise by 8.6% and Saskatchewan once again reported the largest growth rate at 8.9%. Cattle receipts continued to trend up in 2024 with an increase of 11.4% over 2023. That’s lower, however, than the annual growth rate of the previous two years, and thus profitability pressures in the cattle sector could explain the muted increase in pastureland values.

Bottom line

Saskatchewan recorded the largest growth rate in average farmland values across all three land types included in our report. In many ways, the province reflects well the overall trend across the country. Farm operations continue to invest in their operations to gain productivity. They implement new technologies, find efficiencies within their existing production processes, and also benefit from economies of scale when expanding and purchasing land. All these factors are a major driver of productivity growth.

Uncertainty and volatility are expected to be significant in 2025 due to potential trade disruptions at the US/Canada border. Hence, farm operations are also cautious when buying farmland, knowing that farmland has never been more expensive than at the end of 2024, when evaluated against farm income. We will dig into the topic of farmland affordability in our blog post next week.

Article by: Corbin Chau, Data Analyst, Valuations