Canadian farmland affordability trending down

The average value of Canadian farmland continued its steady ascent in 2024, with an increase of 9.3%, which is slightly lower than the 11.5% bump observed last year. This growth was propelled by the limited availability of farmland for sale coupled with a resilient demand (despite an 11.8% decline in major crop receipts). Slightly lower interest rates also contributed to support demand.

This post provides an update to our initial farmland affordability index released last year, which focused on newly acquired land. The affordability of new purchased farmland continued to deteriorate in 2024. We examine each province individually, considering factors such as unique growing conditions, land prices, crops and livestock raised, and proximity to urban populations, all of which influence changes in farmland value. Furthermore, we assess the annual payments for owned farmland over time in relation to its revenue-generating capacity.

Measuring farmland affordability

For many farm businesses, farmland is a key asset. Trends in farmland prices can affect financial performance and business growth over time. FCC’s farmland affordability index provides information on Canadian farmland prices, assisting farming businesses in making informed decisions about their farmland assets and investments.

The index represents the relationship between the annual payments for newly purchased farmland and the income potential derived from that land. A higher ratio indicates decreased affordability in acquiring farmland, as a larger portion of revenue is required to service the debt. Read last year’s blog for more detailed information on the calculations.

Affordability index for newly purchased farmland in Canada deteriorated last year

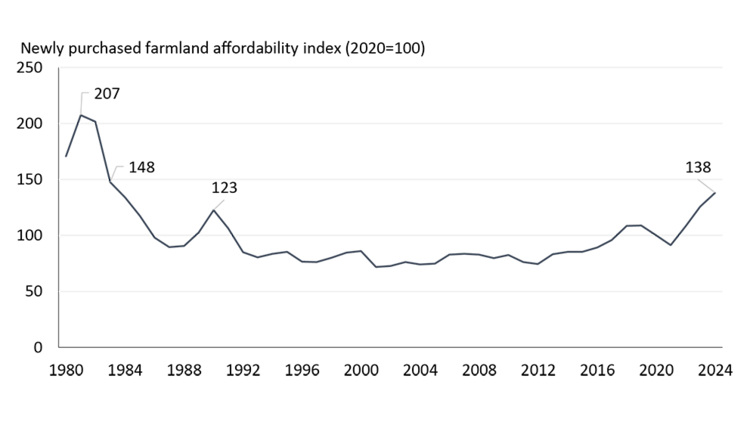

Farmland affordability in Canada worsened in 2024, reaching levels not seen since 1983 (Figure 1). The index is mainly influenced by Saskatchewan and the Prairies due to their vast acreage. Reduced affordability was driven by lower farm cash receipts and higher farmland values. Since 2020, farmland values and interest rates have risen faster than farm revenue. While established farmers gained equity, the cost of farmland increased relative to its income potential.

Figure 1: Newly purchased farmland affordability in Canada deteriorated again in 2024

Sources: Statistics Canada, FCC calculations

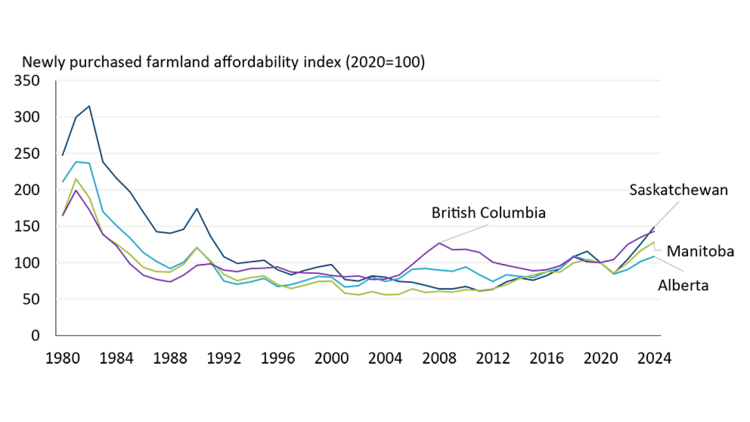

All provinces in Western Canada remain significantly below the record levels established in the 1980s. Saskatchewan saw the largest deterioration due to a rise in the value of farmland and a decline in farm cash receipts, with the index being at the highest level since 1990 (Figure 2). Alberta and Manitoba experienced similar trends in 2024, with farmland values up and farm cash receipts down, marking Manitoba's highest level since 1983 and Alberta's since 2018. British Columbia, despite an increase in farm cash receipts, saw its index rise again (i.e., a deterioration in affordability) due to rising farmland values.

Figure 2: Affordability of newly acquired farmland in Western Canada deteriorated in 2024 but remains significantly below historical peaks

Sources: Statistics Canada, FCC calculations

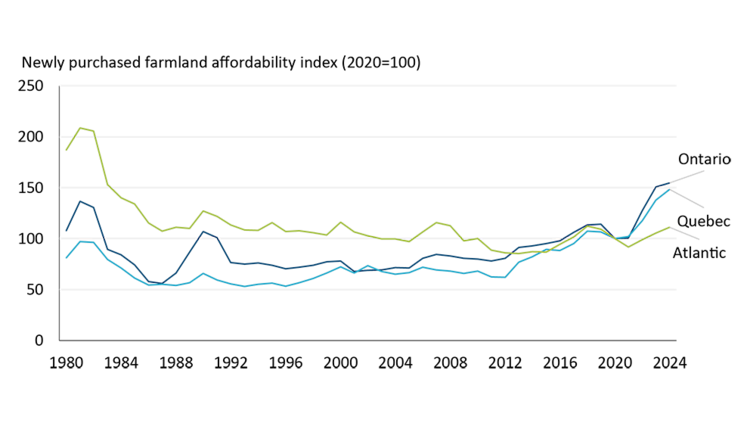

In 2024, farmland affordability was the worst on record in both Ontario and Quebec. Both provinces had lower farm cash receipts compared to the previous year, accompanied by an increase in farmland values (Figure 3). Despite a decline in affordability in Atlantic Canada, this region experienced relatively small increases over the past five years and remains significantly below the levels observed 30 years ago.

Figure 3: Newly purchased farmland affordability declined again in Ontario and Quebec

Sources: Statistics Canada, FCC calculations

The unaffordability of newly purchased land affects all producers looking to acquire land and presents significant challenges for those aiming to expand their land base, including young producers, Indigenous peoples, and new entrants. However, only a small amount of land changes hands each year, with most being held long-term, often across generations. For these farmers, we can evaluate their success over time in generating farm cash receipts relative to actual land payments.

How are existing landowners performing in terms of generating revenue relative to land costs

According to Statistics Canada's balance sheet of agriculture, Canadian farmers collectively hold approximately 85% equity in their operations. Since the largest component is farm real estate, we assume that farmland equity is at that level, indicating that mortgage payments are only being made on 15% of the value of farm real estate. Equity levels range from about 70% in Atlantic Canada to nearly 90% in Saskatchewan.

We can evaluate farmland affordability for owned land based on the Saskatchewan Ministry of Agriculture's formula for land investment cost. For Canada, this involves applying 85% land equity to a 1.5% land opportunity cost, with the remaining 15% allocated to mortgage principal and interest over 25 years. In 2024, the average payment for newly purchased land in Canada was $309 per acre, whereas the payment for owned land was $115 per acre using this method. We use this value applied to total seeded acres as a percentage of farm cash receipts to create a ratio as shown in figure 4.

Performance of owned farmland varies nationwide

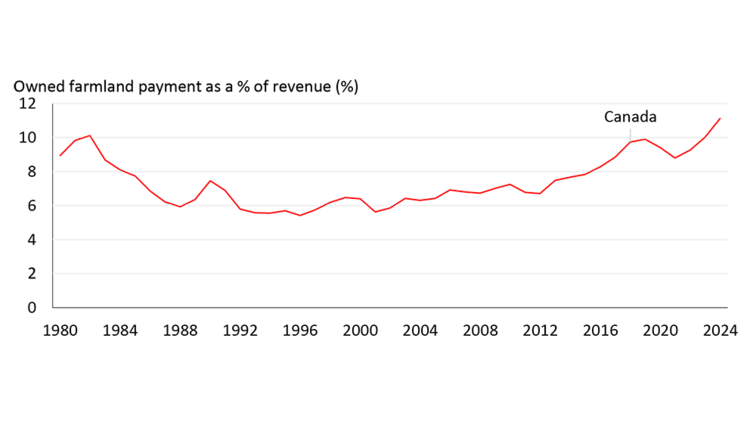

The owned farmland payment as a percentage of revenue in Canada reached its highest point historically in 2024. The average land payment represented 11% of farm cash receipts last year, or essentially for every $1 in revenue generated, there was $0.11 in land payments. Since the early 1990s, the average annual payment has slowly been increasing relative to growth in farm cash receipts. The last decline in the ratio was in 2021 when mortgage rates declined to a low of just over 3%.

Figure 4: Owned farmland payment as a percentage of revenue in Canada is the worst on record

Sources: Statistics Canada, FCC calculations

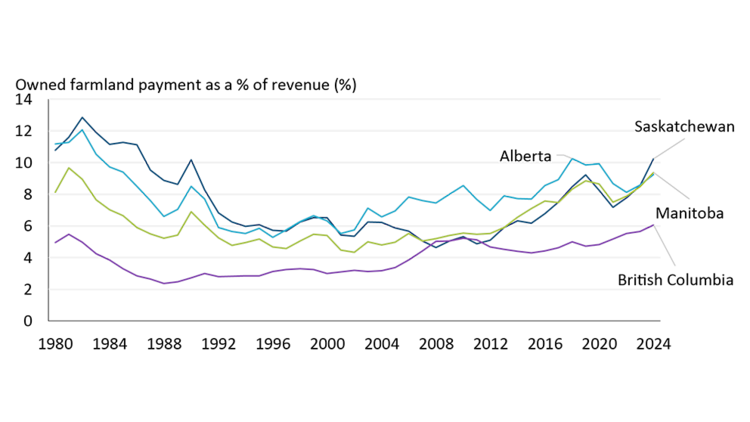

At the provincial level, it is possible to observe how different areas perform in generating farm cash receipts relative to their average land payments. British Columbia has the highest priced farmland in the west, but landowners pay $0.06 in payments to generate $1 in farm cash receipts, which represents an efficient performance. The three Prairie provinces have seen an increase in their land payments as a percentage of revenue in recent years, indicating that on average farmland value growth is surpassing revenue growth.

Figure 5: British Columbia farmland payment is relatively small to the revenue generated

Sources: Statistics Canada, FCC calculations

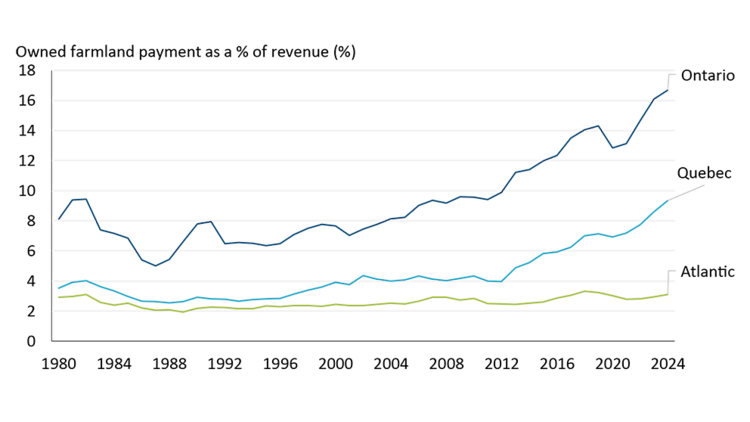

Much like the recently acquired farmland, Ontario and Quebec exhibit a trend of diminishing affordability in already owned farmland. Ontario is the most challenged area in the country for generating revenue relative to the annual cost of land ownership, for every $1 of revenue, $0.17 goes towards farmland payments. While Quebec is below the Canadian average, since 2012 the average farmland payments has been rapidly increasing. Affordability in the Atlantic declined this year but remained relatively stable compared to other regions.

Figure 6: Ontario farmland payments continue to increase relative to revenue potential

Sources: Statistics Canada, FCC calculations

Despite the rise in farmland payments as a portion of revenue, most producers have been able to generate sufficient cash flow to fulfill their annual payment obligations.

Bottom line

Net agricultural margins in Canada for 2024 remained strong, contributing to increased farmland values and presenting affordability challenges for purchasing additional land. Net margins are expected to tighten in 2025 due to a second consecutive year of declining receipts for grains and oilseeds. The persistence of high costs and trade disruptions may lead to lower revenues and higher expenses. This could lead operations to be cautious about farmland purchases in 2025.

Senior Economist

Justin Shepherd is a Senior Economist at FCC. He joined the team in 2021, specializing in monitoring agricultural production and analyzing global supply and demand trends. In addition to his speaking engagements on agriculture and economics, Justin is a regular contributor to the FCC Economics blog.

He grew up on a mixed farm in Saskatchewan and remains active in the family operation. Justin holds a master of applied economics and management from Cornell University and a bachelor of agribusiness from the University of Saskatchewan.