Cattle herd declines amidst strong prices

The cattle market continues to experience a multi-year run of strong prices, offering robust marketing prospects for the industry. Year-over-year (YoY), cattle prices across all categories are set to increase and remain significantly above the 5-year averages. Since our early 2024 forecast, cattle prices have risen by $5-30 per hundred weight (cwt), with cow-calf producers seeing the most substantial gains.

Table 1: Cattle prices have trended higher in 2024

Livestock prices | 2024 forecast | 2023 average | 5-year average |

|---|---|---|---|

Alberta fed steer $/cwt | 240 | 225 | 165 |

Alberta 550 lb steer $/cwt | 380 | 335 | 235 |

Alberta 850 lb steer $/cwt | 315 | 285 | 205 |

Ontario fed steer $/cwt | 230 | 225 | 165 |

Ontario 550 lb steer $/cwt | 345 | 295 | 215 |

Ontario 850 lb steer $/cwt | 300 | 280 | 205 |

With cattle prices rising year over year, the margins for the cow/calf sector are projected to remain significantly above the five-year average.

Despite a successful first hay cut due to early season moisture, Alberta hay prices have stubbornly stayed high, with second cuts being limited after a hot and dry summer. Even then, feedlot profitability has been aided this year by declining feed grain costs, including lower prices for feed barley and corn compared to our early season outlook and their five-year averages (Table 2).

Table 2: Feed costs forecasted to offer a reprieve

Feed costs | 2024 forecast $/tonne | 2023 average $/tonne | 5-year average |

|---|---|---|---|

Feed barley (AB) | 255 | 350 | 280 |

Corn (ON) | 230 | 300 | 260 |

While feedlot margins have benefited from reduced feed costs, fed cattle prices have not increased as much as steer prices, which has balanced the overall impact. Retail beef prices are up over 25% in the last three years and consumers budgets in 2024 are tight. Knowing there is little room to pass on further prices increases, packers are limiting bid prices for fed cattle, causing this price discrepancy. While beef prices at the grocery store aren’t likely to go up, shoppers also won’t see any savings.

Canada’s beef breeding herd declined, again

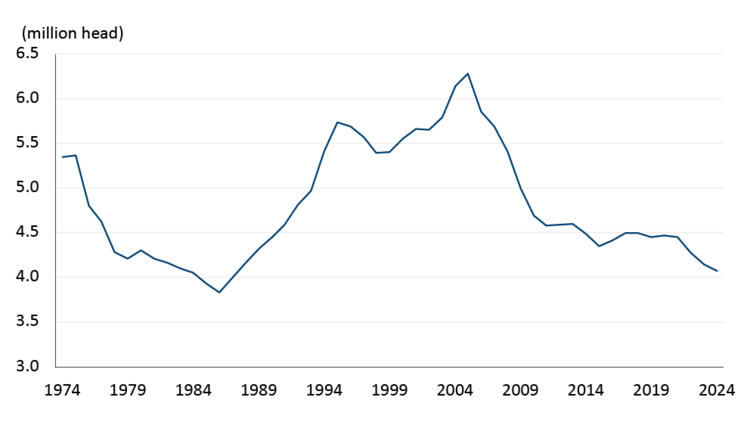

Canada's beef cow and replacement heifer herd has been on a downward trend since its peak 20 years ago, and as of July 1, 2024, it was the smallest since 1987. The total cow inventory decreased by 2% year-over-year. Upon closer examination, heifers intended for beef replacement increased by 1%, while mature beef cows declined by 2%. Given that both groups contribute to future calf production, this indicates 2025 may not yet be the year for herd growth.

Figure 1: Canadian cow and heifer for beef replacement herd at its lowest since 1987

Source: Statistics Canada

The reduced size of the beef herd is evident in slaughter facilities, with beef cows and heifers accounting for 48% of slaughter from January to July this year. This represents the largest percentage of female cows in slaughter since 2012, reflecting last year's decisions by producers to send heifers to feedlots.

Looking ahead, will decreasing feed costs, strong calf prices, and relatively better forage availability on the prairies in 2024 encourage cow-calf producers to expand the breeding herd?

Beef exports will be the key if the Canadian herd grows

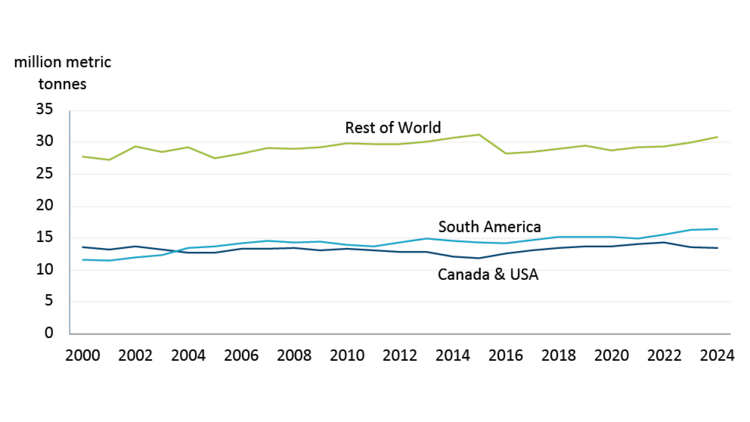

With fewer cattle being produced, plants are relying on slaughtering heavier cattle to compensate. Up to July, Canadian federally inspected carcass weights have risen 6% this year, averaging 963 pounds (lbs.)—nearly 100 lbs. heavier than a decade ago. This efficiency gain means Canadian plants produce 5% more beef per year compared to 2000 while slaughtering 10% fewer cattle. Combined with the U.S., which has an integrated cattle and beef system with Canada, overall beef production has remained steady since 2000. In contrast, South American countries now produce 42% more beef annually compared to 2000, and the rest of the world is up 11%.

Figure 2: Global beef production is growing outside of Canada and U.S.

Source: USDA PSD

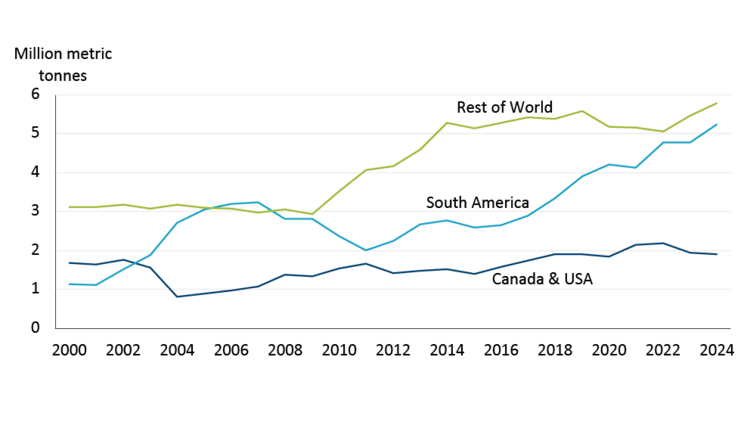

Domestic beef consumption has been stable for 25 years, with population growth offsetting per capita consumption declines. There are opportunities for Canada to increase exports of live cattle and beef if the herd expands. Canadian beef exports have risen only 5% since 2000, compared to an 18% rise in the U.S. (13% combined). Meanwhile, South American exports soared by 360%, and global exports are up 85% (Figure 3), highlighting that there is strong global demand.

Figure 3: Global demand for beef is increasing, but export growth is happening outside North America

Sources: USDA PSD, FCC Calculations

vCOOL and Canadian beef

One of the risks for Canadian beef producers is the upcoming January 1, 2026, implementation of the USDA’s voluntary country of original labelling (vCOOL) ruling that requires meat manufacturers who label their beef as "Product of USA" to use only animals born and raised in the U.S. The Canadian beef industry relies heavily on the U.S. market for live cattle exports as well as beef.

At first glance vCOOL seems less worrisome than mCOOL was (mandatory version running from 2009-2014), given the voluntary nature of the ruling. Still, if consumer demand for products made with a “Product of the USA” label truly exists – and if retailers demand it – manufacturers in the U.S. may rethink how much Canadian-raised livestock they need to source their plants. It’s true that there is growing demand for beef in other parts of the world, which Canadian producers could tap, but increasing those export markets will be challenging with strong global competitors.

Bottom line

At this stage, there is not strong evidence showing that the beef herd is about to start increasing in Canada. Recent months have seen a declining ratio of heifers placed on feed relative to 2023 but it is too early to call it a trend. High calf and cow prices could be fueling small operations to exit at an opportune time, and while larger operations will take up some of the herd, the data yet does not signal that producers in aggregate are ready to grow.

Article by:

Justin Shepherd, Senior Economist

Leigh Anderson, Senior Economist