COVID-19 impacts on Canadian dairy

The following analysis was published prior to the Government of Canada’s announcement of financial measures to support farmers, food businesses and food processors.

COVID-19 has rocked the dairy market in unexpected ways since the publication of our 2020 Dairy Outlook. We project lower profitability for dairy producers due to decline in demand.

Margins were strong in the first two-and-a-half months of 2020, but the outlook is negative in the second quarter. We expect demand to recover in the third quarter under a gradual re-opening of food services. It will take months for the industry to work through butter stocks, limiting the potential for revenues to increase.

Production-limiting measures will support prices. We forecast average revenue in the P5 to decline by 0.91 $/hl in 2020 compared to 2019 (Table 1). In the Western Milk Pool (WMP), we expect a more moderate revenue decline of 0.11 $/hl.

Grain prices are also projected lower in 2020 compared to 2019. In the P5, we forecast total costs to dairy farms to decline by 0.44 $/hl. However, in the WMP, we forecast costs to increase by 0.62 $/hl. In net, margins will decline in 2020 in the two regions.

Table 1. Estimates of dairy farm revenues and costs

| Gross revenues ($/hl) | Total costs ($/hl) | ||

|---|---|---|---|

| P5 | 2018 | 75.48 | 80.11 |

| 2019 | 79.30 | 81.05 | |

| 2020f | 78.39 | 80.61 | |

| WMP | 2018 | 79.50 | 74.13 |

| 2019 | 81.27 | 75.92 | |

| 2020f | 81.16 | 76.65 | |

Sources: Calculations by FCC based on the cost of production estimates from the Canadian Dairy Commission and Government of Alberta and data from the Dairy Farmers of Ontario, Statistics Canada and USDA.

It’s a tricky exercise to forecast prices in the current market conditions, and margins don��’t offer a complete picture of dairy farms’ profitability. Operations incur costs from expansion and contraction of production that are difficult to estimate. Calculations don’t include the butterfat premium and penalties for over-quota production.

Demand for dairy products declined, but retail prices are competitive

Confinement measures led to hoarding behaviour, and the demand for dairy products suddenly rose. Foodservice closures led to major shifts in consumption patterns. The basket of dairy products consumed at home differs from the one consumed away from home. In particular, the demand for cream tumbled.

Dairy products were well-positioned relative to other proteins before the start of the crisis. The African Swine Fever (ASF) outbreak in China caused inflationary pressures on prices for animal proteins. From March 2019 to March 2020, retail dairy prices grew by 2.1% compared to 6.8% for beef, 7.6% for pork, 9.6% for chicken and 4.0% for eggs. Temporary closures of meatpacking plants are causing further inflationary pressures on meat prices.

Swift production adjustments required to match softening demand

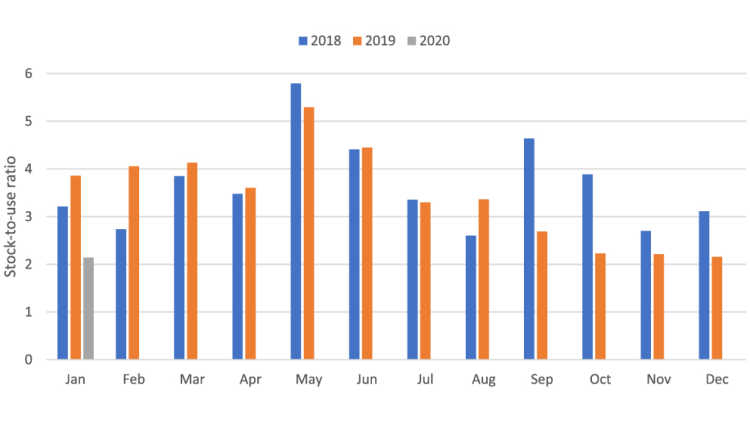

The dairy industry began the year in a good position when it comes to stocks. The butter stock-to-use ratio was high in 2018 but started to decline in the second half of 2019 (figure1). The low stock-to-use ratio in January indicates there was room to expand production before the COIVD-19 crisis and reasons for dairy farmers to be optimistic about 2020.

Achieving a balance between domestic consumption and production is a delicate exercise. This became even more difficult under COVID-19. Dairy boards made several adjustments to production. For instance, in the P5, they include but are not limited to the following:

Third week of March - in response to the initial surge for milk demand, P5 gave an incentive day retroactive to March 1st.

End of March - after the shutdown of most food services, the P5 announced a strict zero credit day policy.

End of April - P5 cut production quota by 2% effective May 1st.

Production adjustments also momentarily required certain producers to dump milk along with the donation of large quantities of dairy products to food banks. We expect the decline in demand from food services to lift-up the stock-to-use ratio of butter starting in April.

Figure 1. Monthly stocks of butter have declined relative to domestic disappearance

Source: Statistics Canada table 32-10-0109.

Issues to keep an eye on for the rest of 2020

When will food services re-open? Profitability for the rest of the year will depend on how early the economy can return towards normalcy.

Low world dairy prices could mean an increase in imports and keep dairy prices low in Canada.

Implementation of the Canada-U.S.-Mexico Trade Agreement (CUSMA) starting July 1st.

Article by: Sébastien Pouliot, Principal Economist