Labour market trends in food and beverage manufacturing

While the labour market eased somewhat in 2024, that’s not to say the food and beverage manufacturing sector’s labour challenge has diminished. Although job vacancies are declining from highs seen during the pandemic, structural labour market issues continue to strain the labour supply over the long term. This suggests the problem of high wage costs, which continue to pressure margins of manufacturers, is unlikely to go away anytime soon. In this report we lay out some of the labour challenges for the sector and put an emphasis on strategies for small businesses.

Labour market pressures ease

The trend we noted last year, on the improving short-term outlook for labour shortages, continued through 2024.

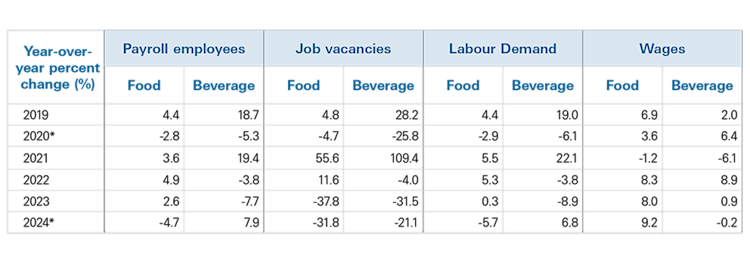

In 2024, labour demand (i.e. payroll employees and vacant positions) in food manufacturing dropped for the first time since 2020. Payroll employees declined 4.7% and job vacancies fell 31.8%. This led to a lower job vacancy rate of 2.6% in 2024, indicating less competition for workers. Despite this, offered wages for food manufacturing trended upwards in 2024 (Table 1).

Beverage manufacturing also experienced a 21.1% drop in job vacancies between 2023 and 2024 and a falling job vacancy rate. However, the number of payroll employees rebounded after two years of declines, boosting labour demand in 2024 by 6.8%. Wage growth in beverage manufacturing has been weaker, but trending in the same direction as food manufacturing over the last five years. In 2024, the trends diverged: offered wages in beverage manufacturing declined, while wages in food manufacturing rose (Table 1).

Table 1: Labour demand and wages for food and beverage manufacturing follow different paths into 2024

*2024 includes Q1 – Q3 data and 2020 includes Q1 and Q4 data only.

Data for NAICS 311 and 312.

Sources: Statistics Canada and FCC Economics

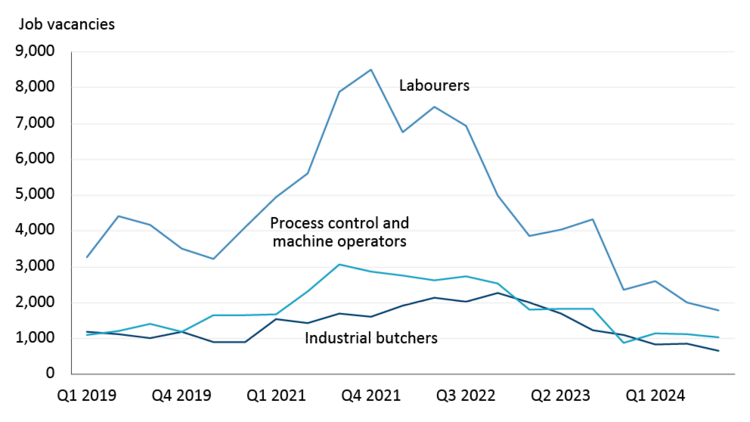

The most common job vacancies are for labourers, process control operators, and industrial butchers, but these vacancies have now reached or fallen below 2019 levels (Figure 1).

Figure 1: Job vacancies in food and beverage manufacturing occupations reach 2019 levels

Source: Statistics Canada

Although competition for workers is softening, this isn’t necessarily a positive sign for the future. The lower demand for labour in food and beverage manufacturing comes as the sector ends the year with flat sales and wages that are playing catch up to inflation. FCC Economics is forecasting stronger sales growth in 2025 but also rising wages. Coupled with the uncertainty around both domestic demand and exports, businesses may be more hesitant to expand their workforce. Additionally, uncertain times have led to paused investment plans, which does not bode well for the sector’s productivity.

Keep an eye on labour supply

According to the Bank of Canada’s Q3 2024 Business Outlook Survey, businesses are seeing an improvement in their ability to find labour, easing the pressure on labour shortages compared to last year.

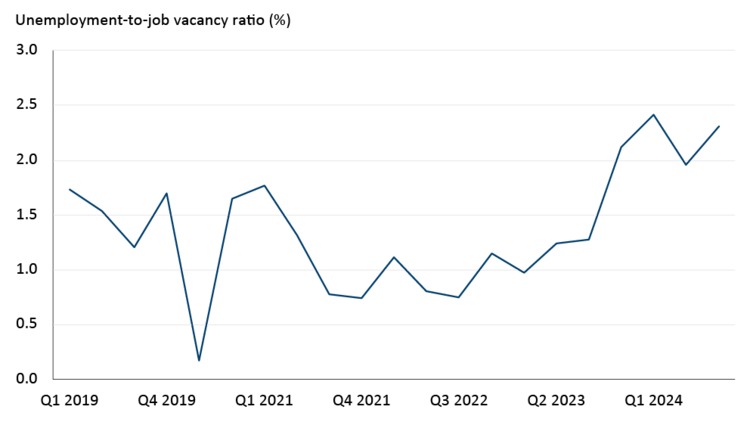

Employment in food and beverage manufacturing is on track to drop slightly in 2024, while unemployment is trending upwards. The unemployment to job vacancy ratio hit 2.3 for the sector in Q3 2024, above the rate observed in 2019. This means there are 2.3 unemployed people that had their last job in food and beverage manufacturing for every available job vacancy in the sector (Figure 2).

Figure 2: Availability of labour increases as unemployment rises against job vacancies

Source: Statistics Canada

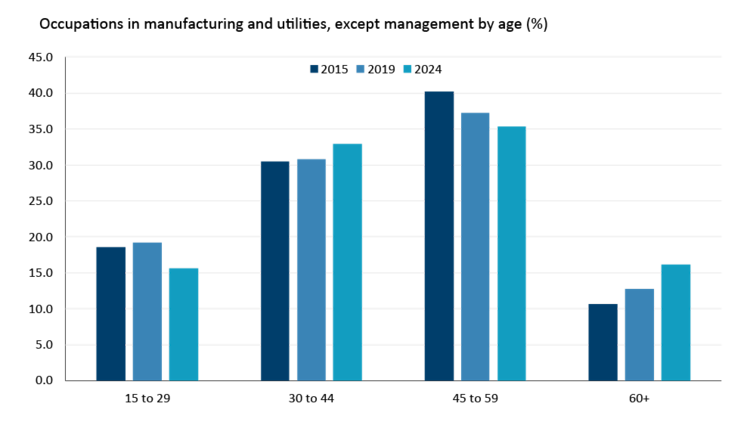

That would normally suggest a softer labour market with more available workers and therefore less pressure on businesses to increase wages. However, the food and beverage manufacturing industry still faces ongoing labour supply issues. The percentage of the labour force over the age of 60 in manufacturing and processing is rising, reaching 16% in 2024 (Figure 3). Including those over 55, this figure jumps to 28%. Looking specifically at food and beverage manufacturing, Food Processing Skills Canada (FPSC) found similar results in a recent study, citing 24% of the workforce is aged between 55 and 64 and will be eligible for retirement in the next 10 years. FPSC estimates that the industry will need to hire and retain 142,000 new workers between 2023 and 2030, or make investments in automation to offset this expected labour demand.

Figure 3: Proportion of labour force in manufacturing and processing over 60 continuing to rise

Sources: Open Government and FCC Economics

Many food and beverage manufacturing businesses rely on temporary labour and immigration to fill vacancies, and it’s unclear how long they will be able to utilize those resources. Recall that the Government of Canada made changes to the Temporary Foreign Worker Program (TFWP), the International Mobility Program (IMP), and the Immigration Levels Plan with the goal of better aligning immigration levels with community capacity. Although food manufacturers are currently exempt from changes to the TFWP, further tweaks to the program cannot be ruled out. Regardless, we’re expecting a tight labour supply to keep wage growth strong, resulting in tight margins for the food and beverage manufacturing industry in 2025.

Highlighting small food and beverage businesses

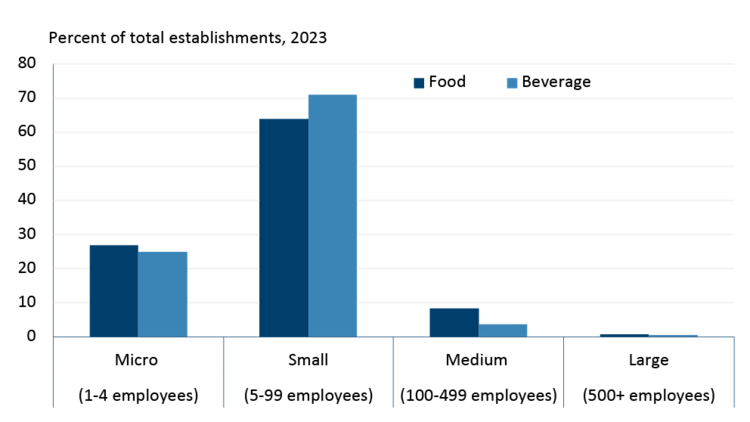

The food and beverage manufacturing sector in Canada is mostly made up of small businesses. Out of nearly 8,700 establishments that have employees1, almost 8,000 have less than 100 employees (Figure 4). Small businesses have the advantage of being more agile and able to adapt quickly to market changes, unlike larger companies that tend to be slower to pivot. However, they face challenges in competing with larger companies for talent due to limited financial and human resources.

Figure 4: Small businesses dominate the share of establishments in food and beverage manufacturing

Source: Innovation, Science, and Economic Development Canada

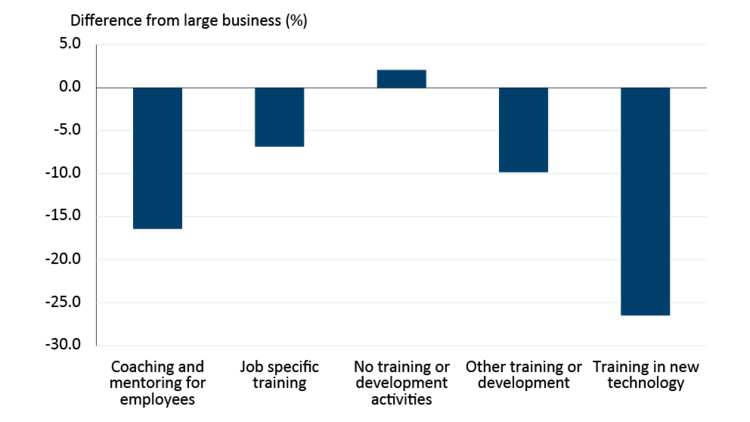

Small businesses often struggle to offer competitive career advancement, training, onboarding, and compensation packages. For instance, nearly 7% fewer small businesses in food manufacturing provide job-specific training compared to larger companies. The gap is even wider for coaching and new technology training (Figure 5). That can impede productivity growth at small firms and if not addressed may threaten their survival.

Figure 5: Fewer small businesses offering training to employees compared to large

Sources: Statistics Canada and FCC Economics

So, what can businesses do?

While small businesses may not be able to match larger companies in financial incentives, they can attract employees by offering non-financial perks like work-life balance, flexibility, and a values-driven workplace. The new workforce values these aspects more than previous ones, providing an opportunity for small businesses to stand out.

At the same time, small businesses should focus on boosting productivity, investing in automation, integrating underrepresented groups, innovating, and leveraging government programs. Many of these strategies are cost-effective, such as recruiting diverse talent, rebranding, engaging on new social media platforms, and reorganizing work responsibilities and team decision making. For these and more costly initiatives, working with experts can help determine the best return on investment.

Bottom Line

The acute labour shortages experienced during the pandemic have subsided, but the structural obstacles to recruit and retain labour in food and beverage manufacturing still persist. Canada’s labour pool is aging, and temporary labour programs are changing so a focus on implementing initiatives to boost productivity and offset future labour pressures are crucial. The difficulty, especially for small businesses, is to balance the immediate labour needs with long-term strategies for growth and innovation.

Amanda Norris

Senior Economist

Amanda joined FCC in 2024 as an Economist. She has expertise in the food and beverage industries, but also does research on supply management and consumer trends. Amanda comes from Agriculture and Agri-Food Canada where she amassed a wealth of economic, technical and industry knowledge through various positions including policy advisor, project lead and Economist.

Amanda holds a master’s degree in Food, Agricultural and Resource Economics from the University of Guelph. She is also a Board member of the Canadian Agricultural Economics Society where she promotes outreach and the importance of agriculture and food research.