Q1 2025 economic snapshot: Long-term opportunities for the Canadian economy despite short-term drag from trade disruptions

The threat of U.S. trade barriers continues to hang over the Canadian economy. Broad based tariffs, which the White House had vowed to impose on Canada in February, were postponed to March, and then again to April. For now, we are keeping unchanged our forecast of 1.6% for Canada’s 2025 GDP growth, although that estimate will likely be downgraded over the course of the year if there’s no further postponement of American tariffs.

While Canada cannot control what its trade partners do, it can influence its own destiny. Policy geared towards boosting productivity would arguably help cushion the blow of tariffs, particularly with respect to removing or relaxing barriers to interprovincial trade. We dive into this recently-revived, decades-old idea in this quarter’s economic snapshot.

Economy was vulnerable, even before trade shock

Forecasters were not particularly bullish about Canada’s 2025 economic prospects, even before the tariff drama unfolded. The economy has indeed been treading water for the last two years with real GDP growth averaging a meagre 1.5% over that period, well below the estimated potential. Worse, real GDP per capita, a proxy for standard of living, fell in both those years, highlighting Canada’s continued challenges in raising productivity.

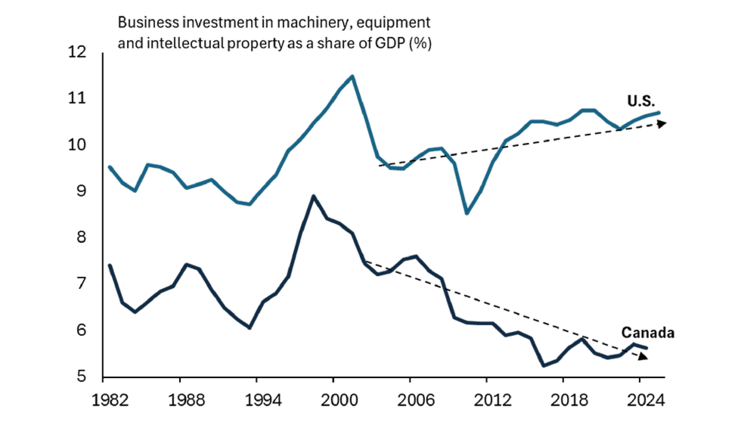

Weakness in productivity growth, and therefore real GDP per capita, has actually been a recurring theme for the past two decades. And it’s not difficult to see why. Since 2002, business investment in machinery, equipment and intellectual property has consistently fallen as a share of GDP to reach just 5.6% last year. That contrasts sharply with the U.S. where the investment share of the economy has climbed steadily to reach nearly 11% last year (Figure 1).

Figure 1: Canada’s business investment heading in the wrong direction

Sources: Statistics Canada, U.S. Bureau of Economic Analysis, FCC Economics

This downtrend in the share of Canadian investment is in dire need of reversal if productivity is to be revived. A concrete action that could help here would be simplifying the regulatory environment in Canada. The Organization for Economic Co-operation and Development (OECD) ranks Canada 25 out of 38th in their overall indicator of product market regulations (which is a rough evaluation how policies promote competition and innovation). The Canadian Science Policy Center identified the regulatory burden in Canada as the most important obstacle to innovation. Public and business investment are intrinsically linked. Targeted public spending can improve productivity, yet issuing government bonds to finance such spending can raise long-term interest rates, restraining private investment (an undesirable effect referred to as “crowding out”).

Unlocking trade amongst provinces offers buffer against tariff threat

Another way to revive productivity is to eliminate internal trade barriers. Over the last several weeks, the idea of reducing interprovincial trade barriers to spur economic growth and counteract the negative economic impacts U.S. tariffs has been raised. This is not a new concept, having been prescribed by the Rowell-Sirois Commission way back in 1940.

What exactly do we mean by interprovincial trade barriers? There are essentially rules and regulations that slow the movement of goods and labour between provinces, such as trucking regulations, licensing requirements, or health and safety rules. Some examples within the food and beverage space include the sale and distribution of alcohol (which provincial governments have various degrees of control over, and all have different rules) and meat (where you are required to be a federally inspected abattoir to sell interprovincially, which can be costly).

Reducing these barriers would be immensely beneficial. An International Monetary Fund (IMF) study from 2019 found that non-geographic internal barriers to trade amount to a 21% tariff we effectively put on ourselves – and that number is about 27% for food products. In 2022, University of Calgary Economist Trevor Tombe estimated that eliminating these barriers could boost Canada’s GDP by between 4.4% and 7.9%. The Bank of Canada estimates a protracted trade war with U.S. would lead to a 2.5% hit to GDP. Based on these estimates, the elimination of interprovincial trade barriers would more than offset the hit to GDP from U.S. tariffs.

In a recent survey, Statistics Canada found that over 45% of agriculture business experienced at least one obstacle when selling goods or services to customers in another province. Outside of transportation related issues, provincial tax laws, difficulty in attaining permits/licenses, and the volume of paperwork to fill out are common grips for those in the industry (Table 1).

There are, of course, geographical barriers that make interprovincial trade naturally difficult. Indeed, the top obstacles below reflect this reality. Still, the barriers are real and, if addressed, would provide significant upside in terms of increased economic growth.

Table 1: Most common obstacles to interprovincial trade for the agricultural sector

Obstacle experienced | % of firms who encountered the obstacle |

|---|---|

Transportation cost | 34.9 |

Distance between point of origin and destination | 12.6 |

Transportation availability | 11.0 |

Lack of profitability | 10.7 |

Provincial or territorial tax laws | 6.1 |

Permits and licenses were difficult to obtain | 5.0 |

Too much paperwork to fill out | 4.3 |

Provincial or territorial language laws | 4.0 |

Transportation regulations were difficult to abide by | 4.0 |

Regulations for this business' industry were difficult to abide by | 3.8 |

Reducing provincial trade barriers one solution to boost productivity

Reducing internal trade barriers would allow investors easier access to the entire domestic market, making investing in Canada more attractive and boosting productivity in the process.

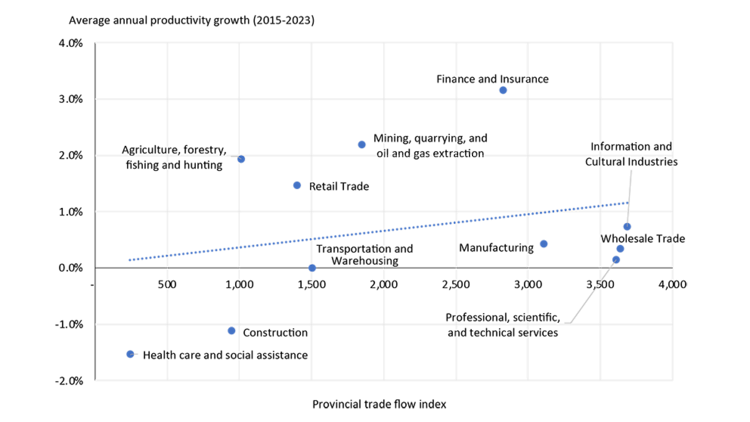

To better understand this hypothesis, we created a Provincial Trade Flow Index (PTFI) which considers an industry’s reliance on interprovincial trade as well as the degree to which each industry has experienced barriers to interprovincial trade. As Figure 2 illustrates, there is a positive relationship between PTFI and productivity growth. Put another way, those industries that have an easier time trading amongst the provinces and / or trade interprovincially at a greater rate tend to have better productivity growth. In the context of the above-mentioned IMF analysis (re: interprovincially trade barriers amounting to a 21% internal tariff), the numbers make tremendous sense.

Figure 2: Industries with greater ease, more frequent interprovincial trade tend to have higher productivity growth rates

Sources: Statistics Canada, FCC Economics

There are clearly other factors at play that would explain why productivity growth over the last decade has been different between the various industries. Still, the relationship exists, and efforts to lower the obstacles encountered by those attempting to trade interprovincially can only help to stimulate productivity growth.

Bottom line

While we are keeping unchanged our forecast of 1.6% for Canada’s 2025 GDP growth, awaiting more clarity on U.S. trade policy, we acknowledge significant downside risk to that estimate. The negative economic consequences of U.S. tariffs will be as diverse as the Canadian economy itself. The potential impacts are largely negative with regards to GDP, employment, productivity, and the Canadian dollar. Amidst all this short-term negativity, opportunities – such as a relaxing of interprovincial trade barriers – do exist, which would better position the Canadian economy in the long-run if seized upon.

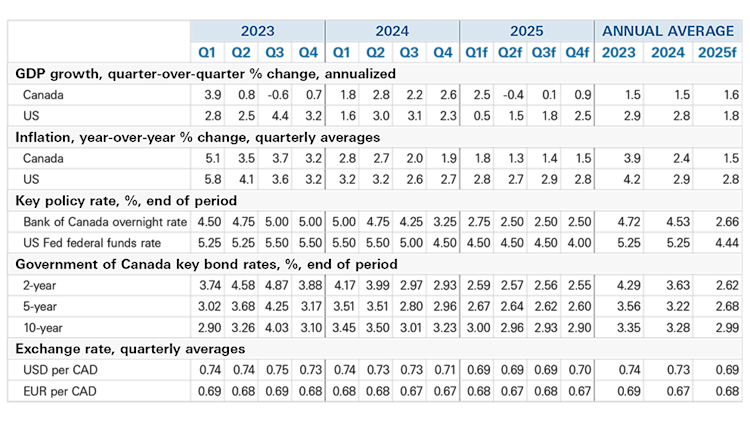

Summary of forecasts of key economic variables

Sources: FCC Economics, Bloomberg

Graeme Crosbie

Senior Economist

Graeme Crosbie is a Senior Economist at FCC. He focuses on macroeconomic analysis and insights, as well as monitoring and analyzing trends within the dairy and poultry sectors. With his expertise and experience in model development, he generates forecasts of the wider agriculture operating environment, helping FCC customers and staff monitor risks and identify opportunities.

Graeme has been at FCC since 2013, spending time in marketing and risk management before joining the economics team in 2021. He holds a master of science in financial economics from Cardiff University and is a CFA charter holder.