What does 2024’s challenging weather mean for 2025 grain and oilseed prices?

This year’s growing season in Canada, and particularly the prairies, was a real roller coaster. Farmers had to come to grips with the lower prices the 2023/24 marketing year brought along while facing challenging weather. Our July outlook highlighted the issues the Western crop was facing as it turned dry during pollination while Eastern Canada was having a better summer with higher yield potential. With most crops in the bin, we look at the year ahead and what could impact expected prices.

New marketing year prices are largely under the average of the past five years

In the 2023/24 marketing year, producers had to reduce their sales price expectations. For several years, prices have generally been higher than, and boosting, the 5-year average. However, new crop prices have now mostly fallen below their 5-year averages (Table 1) but remain well above pre-pandemic levels. In the upcoming marketing year, only feed barley and peas are expected to surpass their 5-year averages. Overall, in the three months since our July outlook, price forecasts have remained relatively stable.

Table 1: Crop prices ($/tonne) for 2024/25 expected to be lower than five-year averages

Cash crop | 2022/23 | 2023/24 | 2024/25 | 5-Year Average |

|---|---|---|---|---|

Corn (ON) | 320 | 240 | 250 | 265 |

Soybeans (ON) | 715 | 610 | 550 | 595 |

Canola (SK) | 845 | 695 | 665 | 690 |

Peas (SK) | 450 | 455 | 415 | 405 |

Lentils (SK) | 815 | 900 | 765 | 765 |

Spring wheat - (SK) | 415 | 335 | 320 | 330 |

Feed barley (AB) | 375 | 280 | 290 | 285 |

Durum (SK) | 475 | 460 | 400 | 435 |

Marketing Year for wheat, canola, barley, peas and lentils: August 1 – July 31

Sources: Statistics Canada and FCC calculations

Grain prices for corn, wheat, and barley are projected to remain steady next year, whereas oilseeds may face lower prices. Peas and lentils could experience price volatility due to trade risks.

Canadian crop production ends up near average after volatile summer

Although some Eastern Canadian producers are still harvesting, Statistics Canada's September 16th estimates predict another strong production year. Final survey-based production estimates for 2024 will be released on December 5, 2024, by Statistics Canada so there will still be changes to crop size. Corn and soybean crops should be similar in size to 2023 but above the 5-year averages (Table 2). Since crop planning began early this year, weak Ontario margins haven't changed much, as lower-than-expected prices were offset by higher yields.

Table 2: Canadian crop production is expected to be average to slightly above

Type of crop | 2023 | 2024 | 2024 relative to 2023 | 2024 relative to 5 Yr Avg |

|---|---|---|---|---|

Barley | 8.9 | 7.6 | -15% | -19% |

Canola | 19.2 | 19.0 | -1% | 4% |

Corn | 15.4 | 15.2 | -2% | 6% |

Lentils | 1.8 | 2.6 | 44% | 18% |

Peas | 2.6 | 3.2 | 21% | -8% |

Soybeans | 7.0 | 7.2 | 3% | 12% |

Durum | 4.1 | 6.0 | 48% | 23% |

Wheat, excluding durum | 28.9 | 28.3 | -2% | 6% |

Western Canada had a more volatile growing season. Prior to seeding we highlighted the extensive drought that correlated with lower yields, but fortunately crop saving rains came in May and June. By the start of July, satellite views of the crop were rated at its highest potential ever, but again the weather changed, and the taps turned off during the crucial pollination period. So, while 2024 turned out to be solid overall, it could have been a true bumper crop had rain showed up in July.

The biggest jumps in production in the Prairies come from a return to average yield for crops like lentils, peas, and durum. All of them are up sharply from last year and highlight how tough 2023 was. Barley production is down this year due to lower seeded acreage as yields were average. Production of canola and wheat are forecast to be down slightly from last year, but above the 5-year average. Crop margins in 2024 for a typical Saskatchewan canola and wheat rotation are unchanged from originally forecast in January, with the second year of losses in a row when including cash rent.

Stocks-to-use provides a guide on potential price moves

A simple way to see potential crop price direction – which will impact Canadian prices – is to look at where the stocks-to-use ratio (a measure of the supply-demand balance) is relative to futures prices. Most futures contracts are priced in USD and the physical location for delivery is in the U.S.

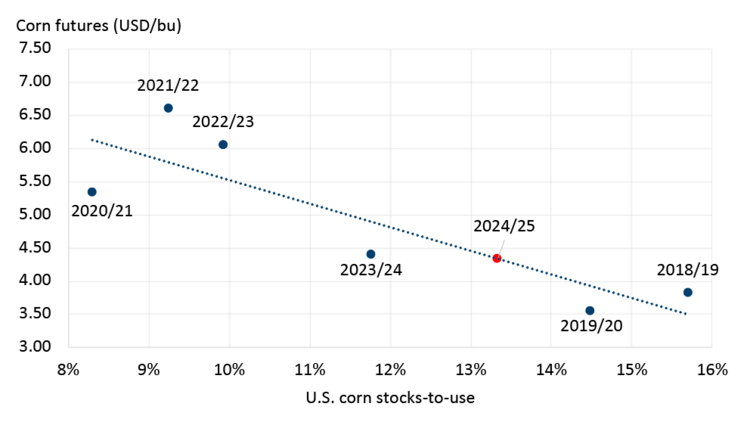

Corn

Despite some tough summer weather, the U.S. corn crop is expected to be large, keeping prices for corn and soybeans down. It's unlikely that U.S. stocks-to-use will drop below 10%, a level where grain traders become more bullish on prices (Figure 1). Even with a slightly smaller crop or increased demand, moving stocks-to-use significantly won’t be easy. The next focus for U.S. corn demand is the South American crop, which is currently being planted and will be harvested in the new year.

Figure 1. U.S. corn stocks-to-use

Sources: USDA, Statistics Canada, FCC Calculations

Wheat

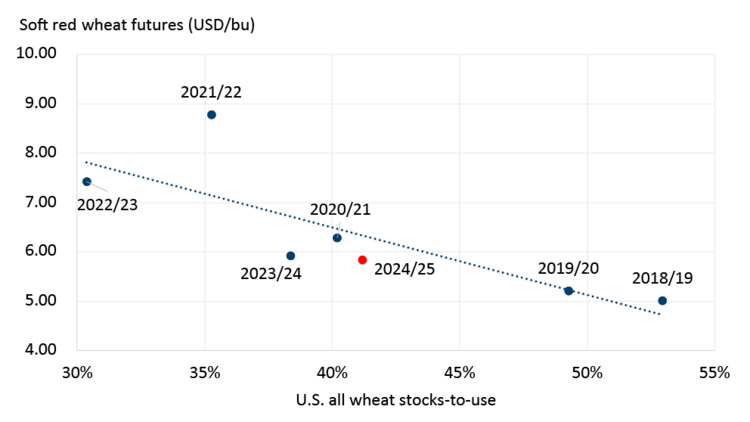

The U.S. is a major wheat exporter but doesn't control global prices, as larger exporters like Russia or the EU have more influence. It acts more like a global reserve, drawing down stocks when prices are favorable. Wheat price and stocks-to-use trends align with corn in the U.S., but wheat stocks-to-use are much larger (Figure 2). With winter wheat planting nearly done in the northern hemisphere, attention shifts to crop conditions and winter weather in regions like the Black Sea, the U.S. Plains, and the EU. Although U.S. stocks-to-use is projected to rise this year, globally they are anticipated to decrease and reach their lowest point since 2014/15 due to consumption exceeding production.

Figure 2. U.S. wheat stocks-to-use

Sources: USDA, Statistics Canada, FCC Calculations

Soybeans

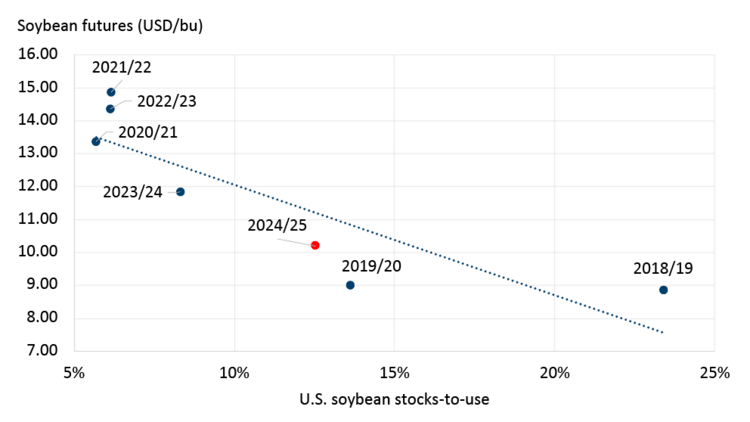

Soybean prices are currently in a grey zone relative to its expected stocks-to-use. U.S. stocks are not projected to be as tight as they were in the past four marketing years. However, U.S. soybean crush capacity is growing in addition to higher expected exports year over year which is preventing stocks from growing back to pre pandemic levels (Figure 3). A significant amount of the new soybean crush capacity is intended for biofuel production, so any weakness in biofuel input requirements could decrease soybean demand. Getting stocks-to-use to fall back to 2020-2023 levels to support prices at a higher level is unlikely to happen unless global supplies falter e.g., a particularly bad South American harvest.

Figure 3: U.S. Soybean stocks-to-use

Sources: USDA, Statistics Canada, FCC Calculations

Canola

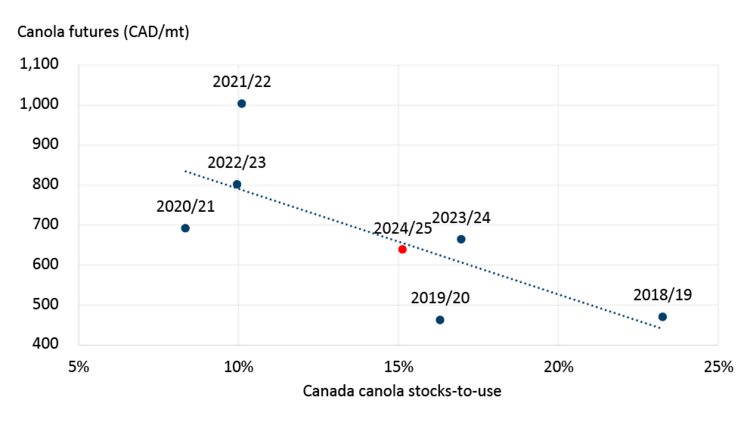

Canola futures are priced in Canadian dollars with prairie located delivery points, so we can compare against Canadian canola stocks-to-use and see it is currently well priced. What could be the demand drivers for the year ahead? We know Canadian crush capacity continues to grow and will likely set another new annual record. Export demand has been good to start the marketing year, including from China, who recently announced an anti-dumping investigation into Canadian canola. For canola stocks-to-use to significantly tighten and push up prices, the Canadian crop will have to end up significantly smaller in addition to substitute oilseed prices like soybeans moving in the same direction.

Figure 4: Canadian canola stocks-to-use

Sources: USDA, Statistics Canada, FCC Calculations

Bottom line

A record harvest would have been possible for 2024 had weather cooperated, but Canada still ended up with an average crop. There are some benefits coming in the year ahead for producers; lower interest rates and a weak loonie are enhancing Canadian crop exports. However, overall margins remain slim for the recently harvested crop, prompting producers to focus on cost management and cautiously evaluate opportunities.

Justin Shepherd

Senior Economist

Justin Shepherd is a Senior Economist at FCC. He joined the team in 2021, specializing in monitoring agricultural production and analyzing global supply and demand trends. In addition to his speaking engagements on agriculture and economics, Justin is a regular contributor to the FCC Economics blog.

He grew up on a mixed farm in Saskatchewan and remains active in the family operation. Justin holds a master of applied economics and management from Cornell University and a bachelor of agribusiness from the University of Saskatchewan.