Outlook update for cattle and hogs: Shifting destinations for red meat exports

This is the update to our May 2022 cattle and hogs outlook, which follows Q1 updates to our grains, oilseeds and pulses and dairy outlooks.

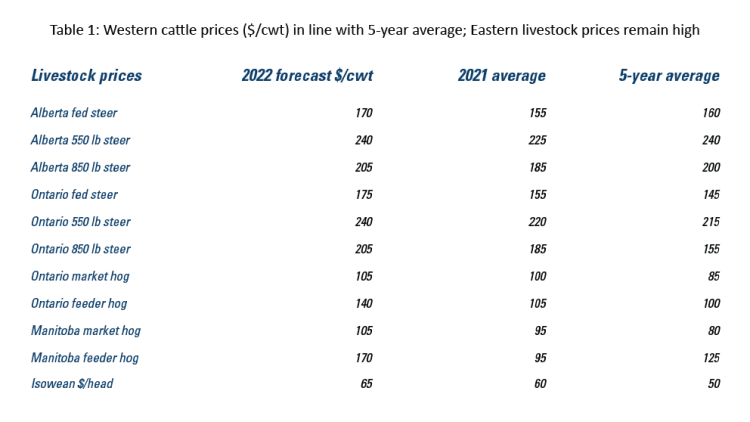

Despite higher-than-average prices, profitability in 2022 will be mixed across the livestock sector. The beef sector continues to benefit from strength of consumer demand, and cattle prices are expected to exceed both the 2021 average price and the most recent five-year average prices throughout 2022 (Table 1). Projected average hog prices for 2022 remain elevated as well, with the caveat that prices will be lower in Quebec if the $40 per 100 kilogram price cut remains in effect.

Sources: Statistics Canada, AAFC, USDA, CanFax, CME Futures and FCC calculations

The pressures on profitability are coming directly from expenses, primarily feed costs. Western feedlots, who are still paying high prices for feed, are unlikely to break even. Cow-calf margins are expected to be positive throughout the outlook period but below their five-year average. There may be weakening cattle prices if the Texas drought forces U.S. producers to cull cattle.

Hog margins are also forecast to be mixed. Farrow-to-finish operations in Manitoba are likely to see positive margins throughout the outlook period, exceeding the five-year average and coming closer to the highs seen in 2017. Isowean operations will struggle to be profitable in both the east and west, but eastern farms will see profitability fall well below the most recent five-year average. It will be difficult to break even for Quebec hog farms if the price cut remains.

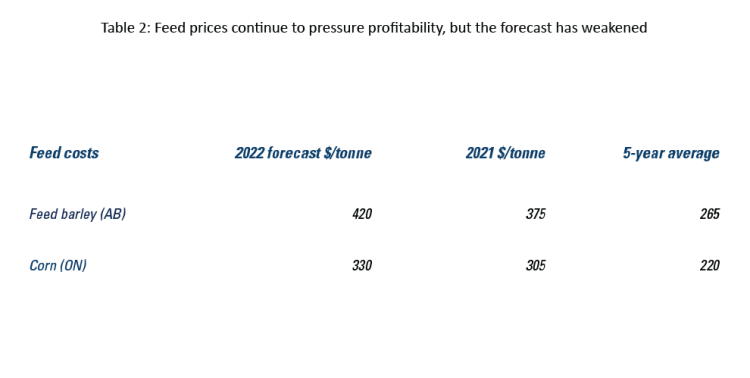

Skyrocketing feed prices in Canada

A key story in 2021 and 2022 has been the sustained lack of feed availability and resulting increase in feed costs. We expect both to continue through the outlook period. However, our forecast for 2022 average prices has come down since our May update, with feed barley falling from $440/tonne to $420/tonne and corn dropping from $355/tonne to $330/tonne (Table 2).

Sources: Statistics Canada, AAFC, USDA, CanFax, CME Futures and FCC calculations

Barley production in the 22-23 marketing year (MY) is forecast higher year-over-year (YoY) based on the assumption of trend yields. But even with the increased supply, carry-out stocks are expected to reach a record low level (0.4 million tonnes (Mt)) in 2022. The stocks-to-use ratio is also forecast to reach a record low of 4%, versus a five-year average of 13%. Prices, which are well above the recent five-year average, may reach a new high this year.

AAFC forecasts corn carry-out stocks for the 21-22 MY crop to be 12% lower than a year ago and 18% lower than the previous five-year average. Looking ahead, estimated record-high acreage and higher YoY production won’t be enough to raise total 22-23 supply over YoY and 5-year average levels. Despite higher production and imports, the corn price may set a new record of $330/tonne.

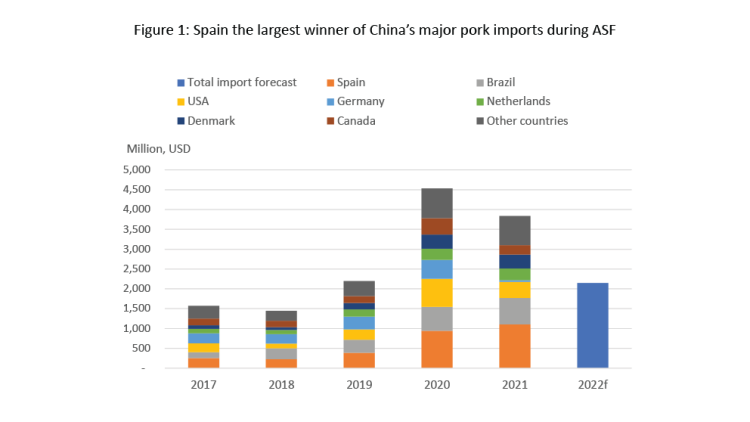

China less reliant on pork imports

In the July WASDE, the USDA revised China’s 2022 pork imports (by volume) to approximately half of 2021 levels as a result of the country’s hog herd rebuild. According to the USDA, the country’s imports were down 64.0% in June YoY. Year-to-date imports were similarly down (65.1%) YoY.

China’s reduction in imports creates uncertainty elsewhere: global pork trade is expected to fall 13% this year, following declines in 2021. This was expected after the massive buying spree of 2020. Figure 1 shows the trends in Chinese import volumes (the height of the stacked columns) and the export trends from China’s largest suppliers over the last five years.

Sources: UNComtrade, USDA Livestock and Poultry (July 2022)

Canadian exporters will need to find room to grow pork exports after losing ground during the record-setting period in China’s fight with African Swine Fever (ASF) It won’t be easy to find profitable opportunities as some of our major competitors are also losing market share. Spain is the only exporter who has consistently grown its export volumes to China since 2017. The USDA notes that while some alternative export markets may open to take more of the excess pork this year (e.g., South Korea, Mexico, the Philippines), they’ll be unable to fill the gap left by China’s downturn.

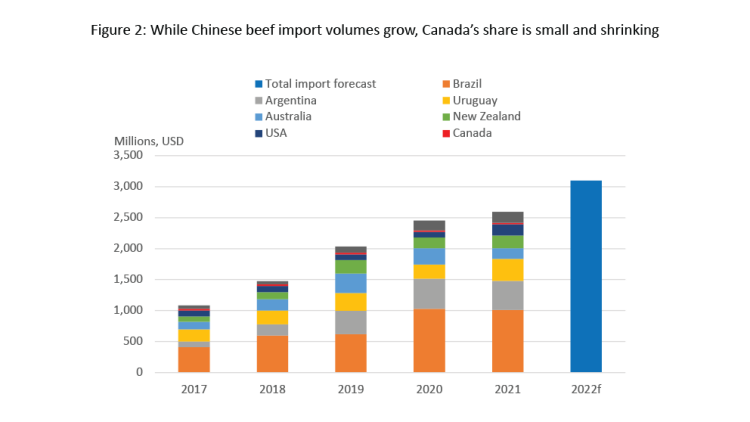

On the other hand, Chinese total beef purchases are expected to continue to grow (shown as the height of the stacked columns), with import volumes forecast to rise 3% in 2022 (Figure 2). That will coincide with a strong general demand for beef from world markets, which the USDA describes as continuing to be firm, despite higher prices.

With beef, too, Canada’s overall share of Chinese imports has fallen.

Sources: UNComtrade, USDA Livestock and Poultry (July 2022)

China relies on South American suppliers to ship almost three-quarters of its total beef imports, with Brazil claiming well over a third of total volumes and Argentina and Uruguay combining to account for another 32%.

Bottom line

Uncertainty in global markets abounds in 2022, as the war in Ukraine continues to disrupt expectations of market availability of grains amidst, in some cases, record-low stocks of feed grains. Feed prices are forecast to be record-high for the year, even if they continue to fall throughout the latter half of 2022. They’ll pressure the profitability of Canada’s cattle and hog sectors at a time when China seems less inclined to buy Canadian red meat. While the hunt for new markets is always on, we could be facing additional pressure to do so.

Martha Roberts

Economics Editor

Martha joined the Economics team in 2013, focusing on research insights about risk and success factors for agricultural producers and agri-businesses. She has 25 years’ experience conducting and communicating quantitative and qualitative research results to industry experts. Martha holds a Master of Sociology degree from Queen’s University in Kingston, Ontario and a Master of Fine Arts degree in non-fiction writing from the University of King’s College.