2022 Cattle and hog outlook update: Mixed profitability for Canada’s red meat sectors

This is the update to our February 2022 cattle and hog outlook, which follows Q1 updates to our grains, oilseeds and pulses and dairy outlooks.

The Russian invasion of Ukraine has changed the feed cost outlook for 2022, and stronger price volatility will continue for the remainder of the year, challenging profitability.

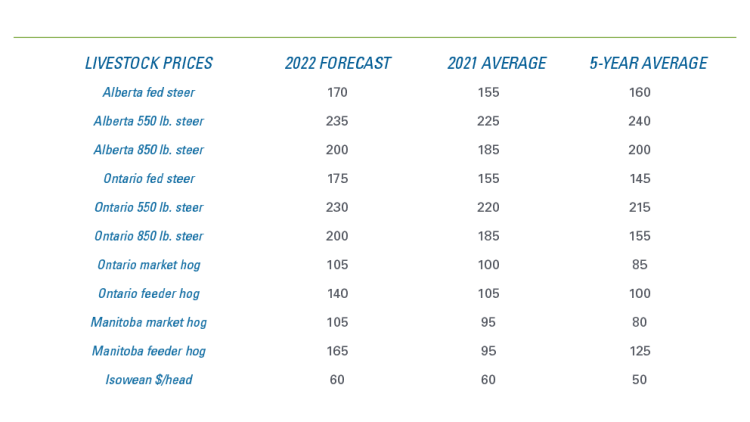

Cattle prices in 2022 are forecasted to remain at or above 2021, but margins will remain under pressure due to high feed costs (Table 1). Feedlot margins are projected to be negative on average, while cow-calf margins are expected to be near break-even. Improved pasture and forage conditions in Western Canada will be critical for profitability in the cow-calf sector.

Ontario hog prices are projected to be significantly higher than the last few years, but margins are projected to be below the 5-year average due to higher feed costs. Quebec hog prices are subject to a temporary price adjustment based on an agreement between producers and processors. April Quebec hog prices were 13.5% lower compared to Ontario, according to AAFC data.

Quebec processors also agreed to reduce Ontario hog slaughters by 5,000 head per week during this time. High feed costs may also put pressure on feeder hog prices that are not fully captured in the Table 1 forecasts. Manitoba hog prices are forecast to be up significantly in 2022. Margins will be tight overall in the hog sector.

Table 1: Livestock prices ($/cwt) are expected to improve YoY and to exceed the 5-year average

Sources: Statistics Canada, AAFC, USDA, CanFax, CME Futures, and FCC calculations.

In February, we identified China’s efforts to rebuild its hog herd, Canadian feed availability and prices, and domestic red meat demand, as three dominant forces impacting profitability of the Canadian cattle and hog sectors. They are still exerting dominance in addition to the war in Ukraine and weather-related impacts on the 2022 global feed supply.

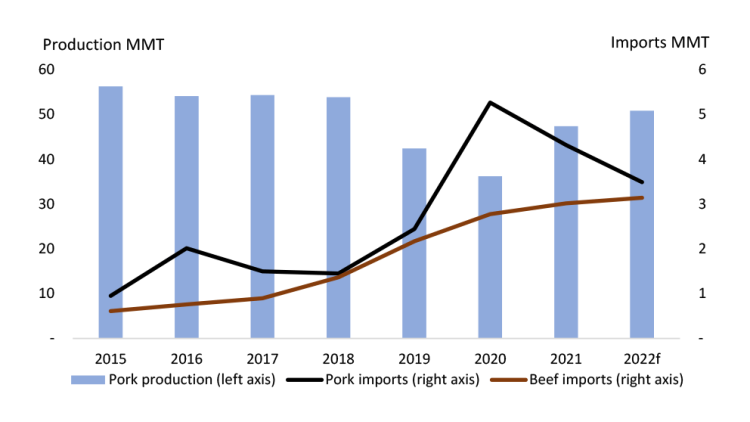

China’s impressive efforts to rebuild hog herd and shifting export destinations

China’s pork production is forecast to grow around 7% YoY, up from the 5% projected at the start of the year (Figure 1). The quicker-than-anticipated recovery of the Chinese hog herd is reducing Canadian pork export opportunities. While production is not back to pre ASF levels, pork supply and demand in China are more balanced. Chinese pork imports are expected to fall 19% in 2022 and are somewhat behind the recent decline in U.S. pork cutout values. Conversely, Chinese beef imports are expected to increase for the third straight year, with the USDA forecasting an increase of 4% in 2022.

Figure 1: Chinese ’22 pork production growth larger than anticipated – reducing pork imports

Source: USDA.

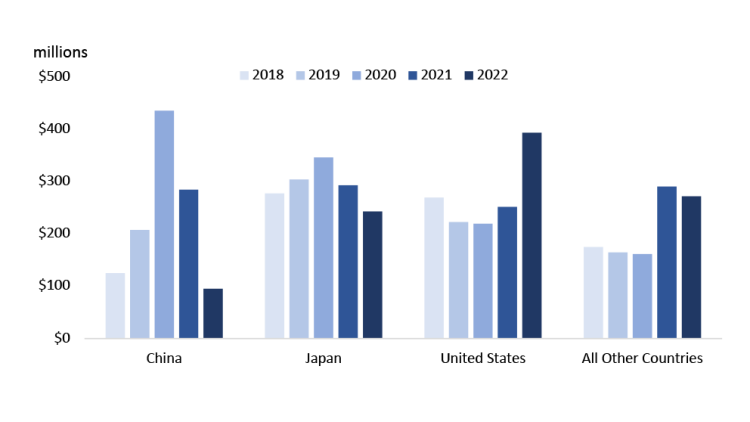

Chinese imports of Canadian pork dropped 67% in Q1 of 2022 compared to the same period in 2021. Canadian exports to the U.S. increased 56% (Figure 2). Total Q1 Canadian pork exports were $1 billion, down 10% YoY. While the value of quarterly exports was the lowest in 3 years, they remain very strong compared to pre-ASF. Very strong cow slaughter in the U.S. and a decline in the U.S. hog breeding herd in Q1 suggest strong demand for Canadian pork and beef exports.

Figure 2: United States largest destination for Canadian pork exports in Q1

Source: Statistics Canada: Includes HS 0203, 020630, 020641, 020649.

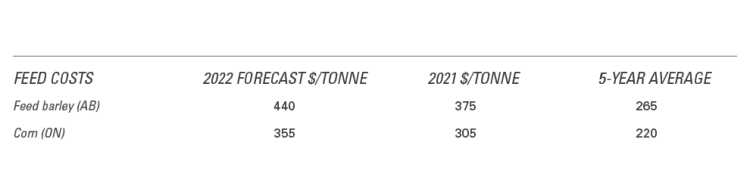

Lack of feed availability and strong prices in Canada

Since the initial outlook, feed availability has further deteriorated with tight global stocks and increased market uncertainty due to the war in Ukraine. Feed costs for 2022 are now projected to be up significantly compared to 2021 for both feed barley and corn (Table 2). Canadian crop year purchases of corn from the U.S. are a record 3.7 million tonnes due to reduced grain production in western Canada.

Table 2: Feed prices remain elevated

Sources: Statistics Canada, AAFC, USDA, CanFax, CME Futures, and FCC calculations.

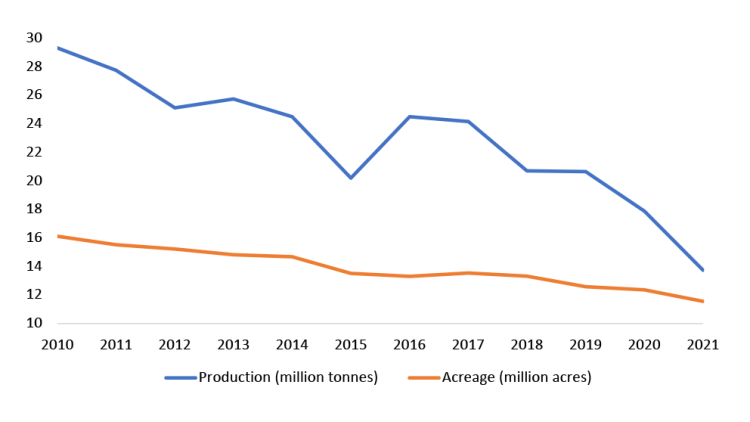

One of the key feeds to watch this spring is tame hay. Last year’s Prairie drought wreaked havoc on production, causing a 7.8 MMT shortfall relative to the 5-year average (Figure 3) and the lowest overall production since 1949. Acres harvested for hay have been trending downward since the 2003 peak, and 2022 spring did not help get cattle back out on the grass. Heavy April snowfall in eastern Saskatchewan/Manitoba and drought conditions in Alberta and southwest Saskatchewan meant producers had to continue feeding hay. Hay prices were up 71% in February YoY and should stay high until stocks can be rebuilt this summer. Spring and summer rains will be needed to help western cattle producers. Conversely, hay production in eastern Canada was extremely strong and supportive of producer margins.

Figure 3: Canadian tame hay acres and production in a downward trend

Source: Statistics Canada

Domestic red meat demand and inflation

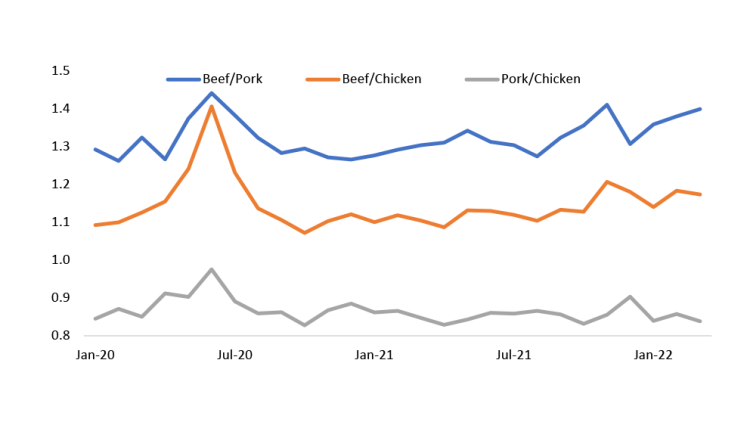

Retail inflation in March at 14.1% for beef led to the protein retail price increase, while pork’s 6.4% YoY increase was the lowest relative to other proteins such as chicken (7.4%) and dairy (9.0%). As consumers head into grilling season, beef has become more expensive relative to pork (Figure 4). Pork has become cheaper relative to both chicken and beef. Poultry, especially turkey and eggs, will likely continue to appreciate in price due to widespread avian influenza hitting North America hard.

Figure 4: Monthly average Canadian retail protein price ratios

Source: Statistics Canada.

Prices for red meats are likely to stabilize at high levels given higher costs across the entire supply chain and the strong domestic and global demand for proteins. Yet, sustained profitability for cattle and hog operations remains elusive in the current environment. A strong 2022 crop would certainly bring relief to feed costs.

Justin Shepherd

Senior Economist

Justin Shepherd is a Senior Economist at FCC. He joined the team in 2021, specializing in monitoring agricultural production and analyzing global supply and demand trends. In addition to his speaking engagements on agriculture and economics, Justin is a regular contributor to the FCC Economics blog.

He grew up on a mixed farm in Saskatchewan and remains active in the family operation. Justin holds a master of applied economics and management from Cornell University and a bachelor of agribusiness from the University of Saskatchewan.