Risk mitigation scores remain elevated in Canadian agriculture

Risk is unavoidable in agriculture, making risk management a key contributor to a farm’s success. In 2020, we analyzed the risk management strategies of Canadian farm operations in a survey about risk perceptions and producers’ implementation of relevant risk management strategies. The last two years have brought new challenges: inflation and rising interest rates, the war in Ukraine, supply chain disruptions, and beyond. So, time for an update!

How we measured

In July, we used the FCC Vision Panel to understand the influence of the evolving operating environment on risk mitigation strategies.

We grouped risks into five categories:

Production

Market

Financial

Human resources

Legal

Each theme includes multiple specific risks. For example, financial risks include interest rate, working capital, debt repayment, and operating costs.

We constructed a scorecard that measures how producers within a sector match their level of concern (on a scale of 0 to 3) with available risk management tools (for example, I have a business plan, off-farm income, utilize accrual accounting to make decisions).

The individual scores are weighted based on the respondents’ risk tolerance level, defined as risk averse, risk neutral, or risk preferring. A score of 100% would indicate that, for every risk identified, there is an appropriate strategy to mitigate. Conversely, zero would indicate there is no appropriate risk mitigation strategy.

Overall risk management strategies follow 2020 results

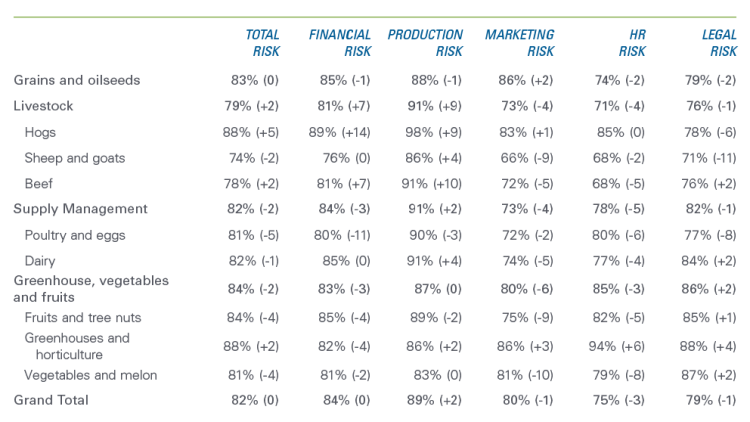

The overall risk score in 2022 remains at 82% (Table 1). Production risk scores increased (+2 overall) but were offset by small declines in legal, HR, and marketing risk scores.

Table 1: Risk scores by sector and categories (change relative to 2020 between parenthesis)

Sources: FCC Vision Survey and FCC Economics

3 takeaways from the survey

Here are three takeaways from this year’s analysis compared to 2020 survey data.

1. Production risk management continues to improve

Our score suggests that 89% of production risks are mitigated by Canadian producers, a gain of two percentage points from 2020. This gain is led largely by the livestock sector, though the supply management score also increased. Small declines were recorded for grains and oilseeds, fruits and tree nuts, and the poultry and egg sectors' sample size was too small for these results to be statistically significant.

2. Human resource risk remains the lowest-scoring risk category

The approach to human resource risks remained a significant challenge and declined slightly compared to 2020. There are opportunities for Canadian farms to mitigate risks in this area by creating a transition plan, purchasing insurance against employee injury or other options that can assist farmers even when family labour is available. Labour shortages are a growing concern in Canadian agriculture and require new and inventive strategies to attract and retain workers.

3. Risk management strategies differ by sector

The livestock sector showed the most opportunity for increased risk mitigation efforts in 2020, and it narrowed the gap in the total risk score with other sectors in 2022. Financial and production risk scores took a noticeable jump in 2022. Financial risk mitigation strategies at a time of high inflation, rising interest rates and higher feed prices and mixed margins are certainly relevant.

Legal risk mitigation scores highest for the greenhouse, fruit, and vegetable sector. The complex retail marketing options and absence of futures contracts in this sector, especially considering the pandemic’s impact on distribution, could necessitate more detailed and frequent contracts. This would make legal risk strategies more important, resulting in higher risk scores.

One puzzling difference between the 2020 and 2022 results is the marketing risk score that declined across multiple sectors and as much as 10 percentage points for vegetables and melon production. The marketing risk category encompasses those risks associated with price fluctuations, changes in the Canadian dollar, and supply chain challenges. The decline in the score may be due to the unique nature of marketing risks’ complex mitigation strategies in these sectors, or producers’ choice to prioritize other risk categories. For example, farms impacted by flooding, fires and droughts this past year would likely place greater importance on addressing production and financial risks first, before considering marketing risk mitigation strategies.

Bottom line

Farm operations are deploying various strategies to mitigate risks. Looking backward at their effectiveness might reveal business areas on a farm that require more attention given risks in agriculture are ever evolving. Being critical of past risk management effectiveness while challenging the operation to account for new emerging risks should provide benefits going forward.

Article by: Ainsley MacDougall, Economist