Weak demand will limit 2025 farm equipment sales and pressure prices

The farm equipment market has been anticipating a slowdown over the past year due to falling commodity prices, high operating costs, and lower profits. In response, farms have placed a greater emphasis on their per acre equipment costs with delayed purchases and plans to further reduce spending on equipment as a cost saving measure. The situation is not unique to Canada with U.S. farmers in a comparable situation. As a result, U.S. farm equipment manufacturers have implemented production cuts due to weak demand. Ultimately, what happens south of the border has implications for the Canadian market.

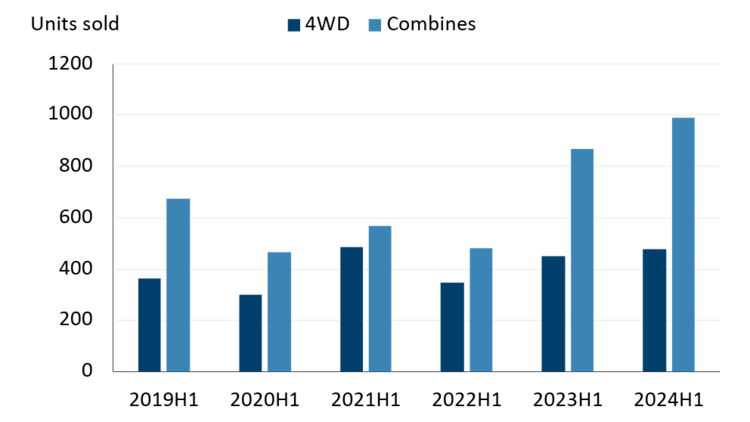

Canadian large equipment sales started this year strong, with increased sales of both combine and 4WD tractors. In fact, new combine sales through the first half of 2024 were the best in five years while 4WD tractor sales were only slightly behind 2021 sales (Figure 1).

Figure 1: Canadian large equipment sales at mid-year were strong

Sources: AEM, FCC calculations

There are several factors as to why this occurred, including strong sales earlier in the year due to weak U.S. sales. U.S. combine sales dropped 17% in the first six months compared to last year. This slowdown allowed U.S. manufacturers to send more pre-orders to Canada earlier. Normally, the Canadian combine market sees the most sales in the second half of the year. This was also a leading indicator of the inevitable slowdown in farm sales we have been expecting.

New equipment sales projected to decline

We are projecting sales of new farm equipment will slow for the rest of 2024 and into 2025 (Table 1). Although 4WD tractor sales have remained strong throughout the first nine months of the year, we anticipate a decline in sales for the final quarter. The market will lose momentum as equipment deliveries arrive early. New farm equipment unit sales are projected to remain soft through 2025 as farmers feel the pressure of low commodity prices, high equipment prices and tighter profitability. However, the decline in sales is expected to be less severe than in 2024, and sales of 4WD tractors should stay above the five-year average.

Table 1: New farm equipment sale growth projections

Equipment type | 2024 relative to 2023 | 2025 relative to 2024 | 2025 relative to 5 Yr Avg |

< 40 HP | -17.9% | -5.4% | -28.8% |

40 - 100 HP tractors | -16.8% | -3.3% | -20.6% |

100+ HP tractors | -8.3% | -5.2% | -6.1% |

4WD tractor | -4.9% | -1.4% | 23.3% |

Combines | -10.8% | -8.0% | -6.9% |

The early arrival of new equipment from manufacturers has led to an increasing number of trade-ins, which has affected the used equipment market. As a result, the slowdown in the new equipment market is expected to spill over into the used equipment market.

Used farm equipment sales projections

Drive past most farm equipment dealer lots and one thing that stands out is the considerable inventory of used equipment. Units sold in the used equipment market are down about 20% compared to the same time last year. Smaller horsepower tractors are down 40% due to the difficult economic conditions and elevated interest rates, which have reduced demand for these tractors typically used for acreages. But it is the used combine market that continues to experience large inventory levels. The shift to more efficient machines, means one large, high-capacity combine can replace two smaller ones. This has led to an increase in the inventory of used combines.

Last year, nearly half of all used combine sales were Class 8, with Class 9 (horsepower determines class) machines close behind. However, there’s been a noticeable trend towards larger, more efficient machines like Class 10+ combines. In 2024, the number of used Class 10+ combines sold has more than doubled compared to the same time last year, while sales of smaller capacity machines have decreased.

We estimate that total used combine sales have dropped by 18% compared to the same period last year, resulting in a significant buildup of used combine inventory.

Sales of used seeding and planting equipment have declined by 23% year over year, marking a slowdown compared to previous years. This trend has significant implications for our manufacturing sector, especially given Canada’s prominent role in seeding and planting equipment manufacturing.

Decline in pre-orders will impact Canadian manufacturing

As mentioned above farm equipment manufacturers in the U.S. have reduced production to align with lower demand. In Canada, manufacturing sales in the first nine months of 2024 have fallen by 8.7% compared to last year. We expect Canadian manufacturing sales to keep declining, ending the year below $6.5 billion. New orders are down 9.2%, suggesting sales will continue to decrease in 2025.

As we look ahead to next year, several factors could impact our projections and producers purchasing decisions.

Trends to monitor in 2025

1. Prices of farm equipment

With sales expected to slow, inventory will build up further. Auction results for the rest of the year will be a key indicator of how the equipment market will perform in 2025. Dealers have already held sales to reduce inventory, and more are expected to follow, including selling surplus equipment at auctions in the coming months. This means farm equipment prices will continue to adjust in 2025.

2. Interest rates and the Canadian dollar

We expect the Bank of Canada to keep lowering the overnight rate through 2025. Lower interest rates could ease financial pressure, making it easier for farmers to buy equipment. However, the Canadian dollar is expected to hit a multi-year low in the first quarter of 2025 before only slightly improving to $0.73 by the end of the year. This could increase imported equipment prices and combined with the margin pressures may be another factor in producers delaying equipment investments.

3. Farm revenue

Lower crop prices are expected to continue into the next crop year, which means farm revenue will still affect the demand for equipment. On the other hand, the cattle sector is doing well with strong cattle prices, encouraging upgrades to livestock equipment. However, cattle producers are cautious due to past droughts and high feed costs, using the current strong prices to recover. As farm revenues improve, farmers will be more eager to invest in new equipment.

Bottom line

The Canadian market for farm equipment is expected to see slower sales next year. With low crop prices, high input costs, and tighter profits, farmers are currently holding back on equipment purchases. Auction results will reveal how willing farmers are to spend. Throughout 2025, as equipment prices adjust and interest rates drop, there might be opportunities for farmers to invest in farm equipment, if it becomes more affordable per acre. If that happens, equipment sales could improve, however, overall sales will still decline.

Senior Economist

Leigh Anderson is a Senior Economist at FCC with experience in agricultural markets and risk. He specializes in monitoring and analyzing FCC’s portfolio, industry health and providing industry risk analysis. In addition to his speaking engagements on agriculture and economics, Leigh is a regular contributor to the FCC Economics blog.

Leigh came to FCC in 2015, joining the Economics team. Prior to FCC, he worked in the policy branch of the Saskatchewan Ministry of Agriculture. He holds a master’s degree in agricultural economics from the University of Saskatchewan.